Relative to the gross margins the subsidiaries report in local currency, Romuluss consolidated gross margin most likely

Question:

Relative to the gross margins the subsidiaries report in local currency, Romulus’s consolidated gross margin most likely :

A. will not be distorted by currency translations.

B. would be distorted if Augustus were using the same translation method as Julius.

C. will be distorted because of the translation and inventory accounting methods

Augustus is using.

Romulus Corp. is a US-based company that prepares its financial statements in accordance with US GAAP. Romulus Corp. has two European subsidiaries: Julius and Augustus. Anthony Marks, CFA, is an analyst trying to forecast Romulus’s 20X2 results. Marks has prepared separate forecasts for both Julius and Augustus, as well as for Romulus’s other operations (prior to consolidating the results.) He is now considering the impact of currency translation on the results of both the subsidiaries and the parent company’s consolidated financials. His research has provided the following insights:

• The results for Julius will be translated into US dollars using the current rate method.

• The results for Augustus will be translated into US dollars using the temporal method.

• Both Julius and Augustus use the FIFO method to account for inventory.

• Julius had year-end 20X1 inventory of €340 million. Marks believes Julius will report €2,300 in sales and €1,400 in cost of sales in 20X2.

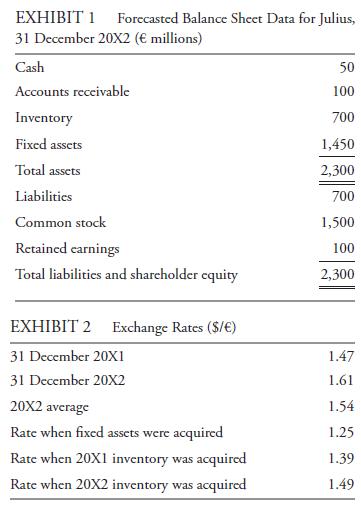

Marks also forecasts the 20X2 year-end balance sheet for Julius (Exhibit 1). Data and

forecasts related to euro/dollar exchange rates are presented in Exhibit 2.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie