Under IFRS Standards, firms can capitalize development outlays, whereas under US GAAP such outlays must be expensed

Question:

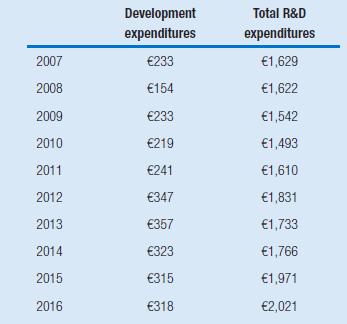

Under IFRS Standards, firms can capitalize development outlays, whereas under US GAAP such outlays must be expensed as incurred. In its 2016 IFRS Standards-based financial statements, Philips Electronics recognized a development asset of €1,079 million (€992 million in 2015). The company’s development expenditures and total R&D expenditures during the period 2007–2016 were as follows (all amounts in millions):

Philips’s statutory tax rate is 25.0 percent.

a Estimate the average expected life of Philips’s investments in development at the end of 2016.

b Using the estimate derived under a, what adjustments should an analyst make to the 2016 beginning balance sheet and 2016 income statement to immediately expense all development outlays and derecognize the development asset?

c What adjustments should be made to the 2016 beginning balance sheet and 2016 income statement to recognize an asset for both research and development investments?

Assume that the average expected life of Philips’s investments in research at the end of 2015 and 2016 is equal to that of Philips’s development investments at the end of 2016.

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu