Question: Barney Ltd has two divisions, each regarded as a separate CGU. The carrying amounts of the net assets within each division at the most recent

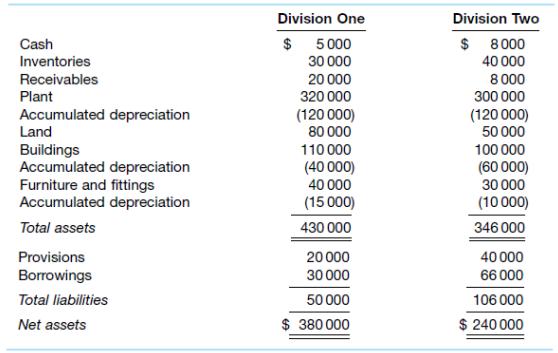

Barney Ltd has two divisions, each regarded as a separate CGU. The carrying amounts of the net assets within each division at the most recent reporting date were:

Barney Ltd also recorded goodwill of \($14\) 000 (net of accumulated impairment losses of \($12\) 000) and had corporate assets consisting of a head office building carried at \($150\) 000 (net of depreciation of \($50\) 000) and furniture and fittings of \($80\) 000 (net of depreciation of \($20\) 000).

Barney Ltd determined that the recoverable amount of the entity’s assets was \($950\) 000.

The management of Barney Ltd then completed the accounting for impairment losses. The

receivables in both divisions were considered to be collectable.

Required

1. Prepare the journal entry to record the impairment loss at the reporting date.

2. Prepare a table of the assets and liabilities of Barney Ltd, using the headings ‘Division One’, ‘Division Two’ and ‘Corporate’, after the completion of accounting for impairment losses.

Cash Inventories Receivables Plant Accumulated depreciation Land Buildings Accumulated depreciation Division One $ 5000 30 000 20 000 320 000 (120000) 80 000 110000 (40 000) Furniture and fittings Accumulated depreciation 40 000 (15 000) Total assets 430 000 Provisions Borrowings Total liabilities Net assets 20000 30 000 50 000 $ 380000 Division Two $ 8000 40 000 8000 300 000 (120 000) 50 000 100 000 (60000) 30 000 (10000) 346000 40 000 66 000 106000 $ 240000

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts