Question: Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company, Olin Corporation, and NewMarket Corporation. (NewMarket was formed from a merger of

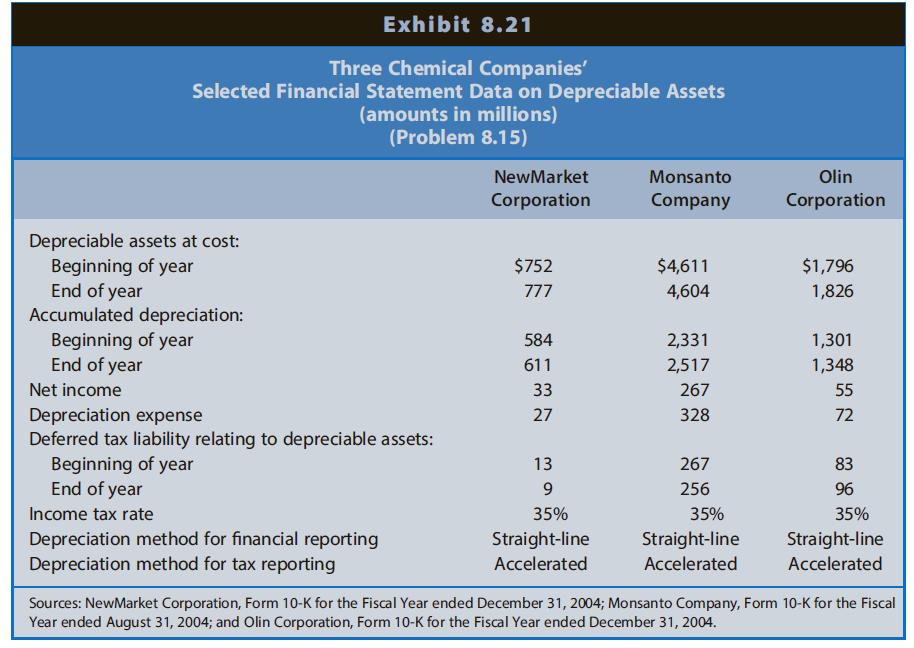

Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company, Olin Corporation, and NewMarket Corporation. (NewMarket was formed from a merger of Ethyl Corporation and Afton Chemical Corporation.)

REQUIRED

a. Compute the average total depreciable life of assets in use for each firm.

b. Compute the average age to date of depreciable assets in use for each firm at the end of the year.

c. Compute the amount of depreciation expense recognized for tax purposes for each firm for the year using the amount of the deferred taxes liability related to depreciation timing differences.

d. Compute the amount of net income for the year for each firm assuming that depreciation expense for financial reporting equals the amount computed in Requirement c for tax reporting.

e. Compute the amount each company would report for property, plant, and equipment (net) at the end of the year if it had used accelerated (tax reporting) depreciation instead of straight-line depreciation.

f. What factors might explain the difference in average total life of the assets of NewMarket Corporation and Olin Corporation relative to the assets of Monsanto Company?

g. What factors might explain the older average age for depreciable assets of NewMarket Corporation and Olin Corporation relative to Monsanto Company?

Exhibit 8.21

Exhibit 8.21 Three Chemical Companies' Selected Financial Statement Data on Depreciable Assets (amounts in millions) (Problem 8.15) NewMarket Monsanto Olin Corporation Company Corporation Depreciable assets at cost: Beginning of year End of year Accumulated depreciation: Beginning of year End of year $752 $4,611 $1,796 777 4,604 1,826 584 2,331 1,301 611 2,517 1,348 Net income 33 267 55 Depreciation expense Deferred tax liability relating to depreciable assets: Beginning of year End of year 27 328 72 13 267 83 256 96 Income tax rate 35% 35% 35% Depreciation method for financial reporting Depreciation method for tax reporting Straight-line Straight-line Straight-line Accelerated Accelerated Accelerated Sources: NewMarket Corporation, Form 10-K for the Fiscal Year ended December 31, 2004; Monsanto Company, Form 10-K for the Fiscal Year ended August 31, 2004; and Olin Corporation, Form 10-K for the Fiscal Year ended December 31, 2004.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step 1 Compute the average total depreciable assets of Company N Average Depreciable Assets n by add... View full answer

Get step-by-step solutions from verified subject matter experts