Question: 8.15 Analyzing Disclosures Regarding Fixed Assets. Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company , Olin Corporation , and NewMarket

8.15 Analyzing Disclosures Regarding Fixed Assets. Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company, Olin Corporation, and NewMarket Corporation. (NewMarket was formed from a merger of Ethyl Corporation and Afton Chemical Corporation.)

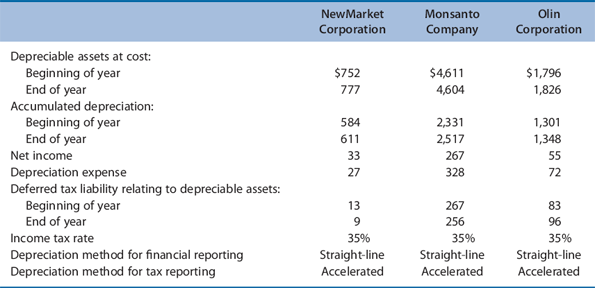

Exhibit 8.21Three Chemical Companies Selected Financial Statement Data on Depreciable Assets (amounts in millions) (Problem 8.15)

Sources: NewMarket Corporation, Form 10-K for the Fiscal Year ended December 31, 2004; Monsanto Company, Form 10-K for the Fiscal Year ended August 31, 2004; and Olin Corporation, Form 10-K for the Fiscal Year ended December 31, 2004.

Required

-

Compute the average total depreciable life of assets in use for each firm.

-

Compute the average age to date of depreciable assets in use for each firm at the end of the year.

-

Compute the amount of depreciation expense recognized for tax purposes for each firm for the year using the amount of the deferred taxes liability related to depreciation timing differences.

-

Compute the amount of net income for the year for each firm assuming that depreciation expense for financial reporting equals the amount computed in Requirement c for tax reporting.

-

Compute the amount each company would report for property, plant, and equipment (net) at the end of the year if it had used accelerated (tax reporting) depreciation instead of straight-line depreciation.

New Market Corporation Monsanto Company Olin Corporation $752 777 $4,611 4,604 $1,796 1,826 1,301 2,331 2,517 1,348 Depreciable assets at cost: Beginning of year End of year Accumulated depreciation: Beginning of year End of year Net income Depreciation expense Deferred tax liability relating to depreciable assets: Beginning of year End of year Income tax rate Depreciation method for financial reporting Depreciation method for tax reporting 267 256 35% Straight-line Accelerated 35% Straight-line Accelerated 35% Straight-line Accelerated New Market Corporation Monsanto Company Olin Corporation $752 777 $4,611 4,604 $1,796 1,826 1,301 2,331 2,517 1,348 Depreciable assets at cost: Beginning of year End of year Accumulated depreciation: Beginning of year End of year Net income Depreciation expense Deferred tax liability relating to depreciable assets: Beginning of year End of year Income tax rate Depreciation method for financial reporting Depreciation method for tax reporting 267 256 35% Straight-line Accelerated 35% Straight-line Accelerated 35% Straight-line Accelerated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts