Question:

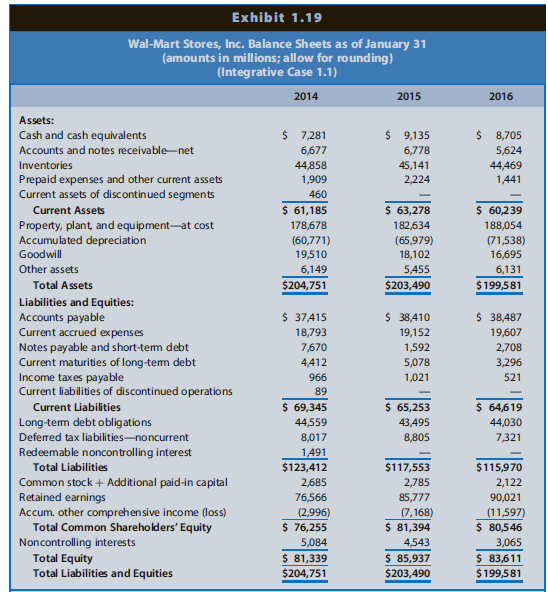

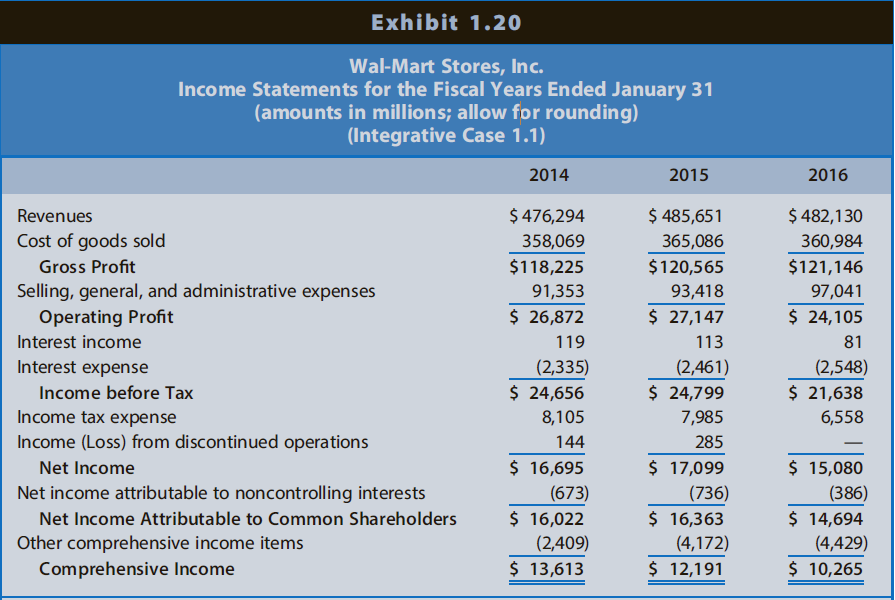

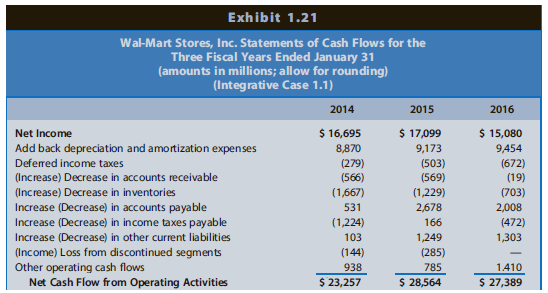

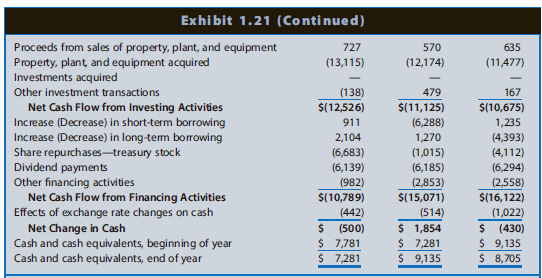

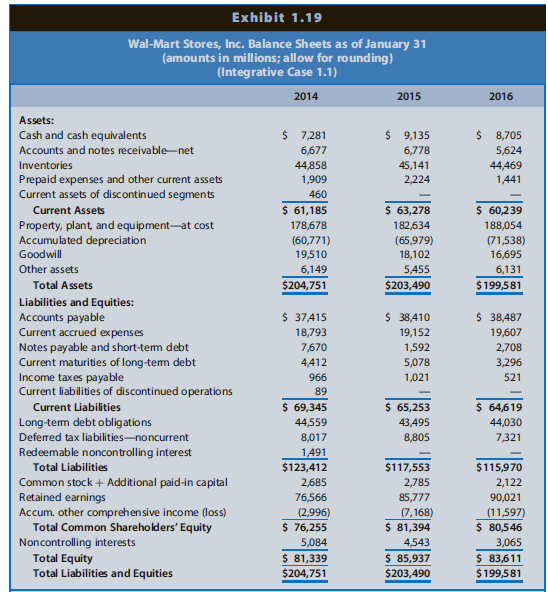

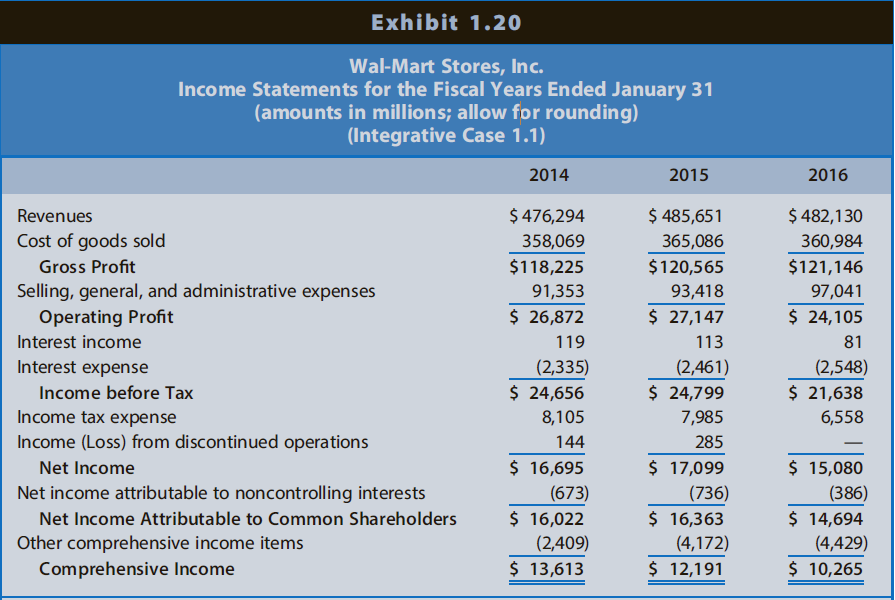

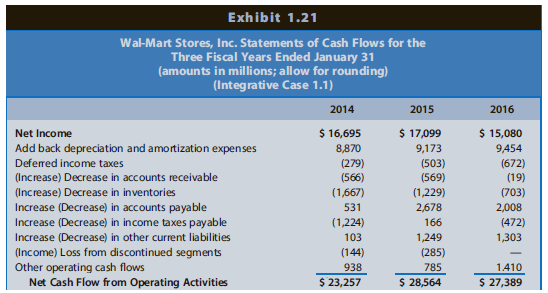

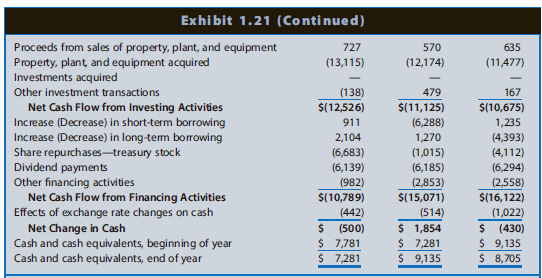

Exhibits 1.19€“1.21 of Integrative Case 1.1 (Chapter 1) present the

financial statements for Walmart for 2012€“2015. In addition, the website for this text contains Walmart€™s December 31, 2015, Form 10-K. Use this information, especially Note 9, €˜€˜Taxes,€™€™ to answer the following questions:

Data from Exhibit 1.19€“1.21

REQUIRED

a. Assuming that Walmart had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for the year ending January 31, 2016 (hereafter, fiscal 2015)? Explain.

b. Assuming all current taxes are paid in cash, will the adjustment to net income for deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or subtraction for fiscal 2015?

c. Walmart reports deferred revenue for sales of gift certificates and for Sam€™s Club membership fees. These amounts are taxed when collected, but not recognized in financial reporting income until tendered at a store. Why does the tax effect of deferred revenue appear as a deferred tax asset?

d. Walmart recognizes a valuation allowance on its deferred tax assets to reflect net operating losses of consolidated foreign subsidiaries. The valuation allowance decreased over the last year. What effect does this have on net income in the most recent year (fiscal 2015)?

e. Walmart uses the straight-line depreciation method for financial reporting and accelerated depreciation for income tax reporting. Like most firms, the largest deferred tax liability is for property, plant, and equipment (depreciation). Explain how depreciation leads to a deferred tax liability. Suggest possible reasons why the amount of the deferred tax liability related to depreciation decreased over the last year.

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

Exhibit 1.19 Wal-Mart Stores, Inc. Balance Sheets as of January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) 2014 2015 2016 Assets: $ 7,281 $ 9,135 8,705 Cash and cash equivalents 24 Accounts and notes receivable-net 6,677 6,778 5,624 44,858 1,909 Inventories 45,141 44,469 Prepaid expenses and other current assets Current assets of discontinued segments 2,224 1,441 460 $ 61,185 $ 63,278 $ 60,239 188,054 Current Assets Property, plant, and equipment-at cost Accumulated depreciation 178,678 182,634 (60,771) (65,979) (71,538) 16,695 Goodwill 19,510 18,102 Other assets 6,149 5,455 6,131 $204,751 Total Assets $203,490 $199,581 Liabilities and Equities: Accounts payable Current accrued expenses Notes payable and short-tem debt Current maturities of long-tem debt Income taxes payable Current liabilities of discontinued operations $ 37,415 18,793 $ 38,410 19,152 $ 38,487 19,607 7,670 1,592 2,708 4,412 5,078 3,296 1,021 966 521 89 $ 69,345 $ 65,253 $ 64,619 Current Liabilities Long-tem debt obligations 44,559 43,495 44,030 Deferred tax liabilities-noncurrent 8,017 1491 8,805 7,321 Redeemable noncontrolling interest $117,553 Total Liabilities $123,412 $115,970 2,685 Common stock + Additional paid-in capital Retained earnings Accum. other comprehensive income (loss) Total Common Sharehokders' Equity Noncontrolling interests Total Equity Total Liabilities and Equities 2,785 2,122 76,566 (2,996) $ 76,255 85,777 (7,168) $ 81,394 90,021 (11,597) $ 80,546 3,065 5,084 4,543 $ 85,937 $ 83,611 $ 81,339 $204,751 $203,490 $199,581 Exhibit 1.20 Wal-Mart Stores, Inc. Income Statements for the Fiscal Years Ended January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) 2014 2015 2016 $ 476,294 358,069 $ 485,651 $ 482,130 360,984 $121,146 Revenues Cost of goods sold 365,086 Gross Profit $118,225 $120,565 Selling, general, and administrative expenses Operating Profit 91,353 93,418 97,041 $ 26,872 $ 27,147 $ 24,105 Interest income 119 113 81 Interest expense (2,335) $ 24,656 (2,461) $ 24,799 (2,548) $ 21,638 Income before Tax Income tax expense 8,105 7,985 6,558 Income (Loss) from discontinued operations 144 285 Net Income $ 16,695 $ 17,099 $ 15,080 Net income attributable to noncontrolling interests (673) (736) (386) $ 14,694 $ 16,022 (2,409) Net Income Attributable to Common Shareholders $ 16,363 Other comprehensive income items Comprehensive Income (4,172) (4,429) $ 13,613 $ 12,191 $ 10,265