Question: In Integrative Case 10.1, we projected financial statements for Walmart Stores, Inc. (Walmart), for Years +1 through +5. In this portion of the Walmart Integrative

In Integrative Case 10.1, we projected financial statements for Walmart Stores, Inc. (Walmart), for Years +1 through +5. In this portion of the Walmart Integrative Case, we use the projected financial statements from Integrative Case 10.1 and apply the techniques learned in this chapter to compute Walmart's required rate of return on equity and share value based on the free-cash flows valuation models. We also compare our value estimate to Walmart's share price at the time of the case development to provide an investment recommendation.

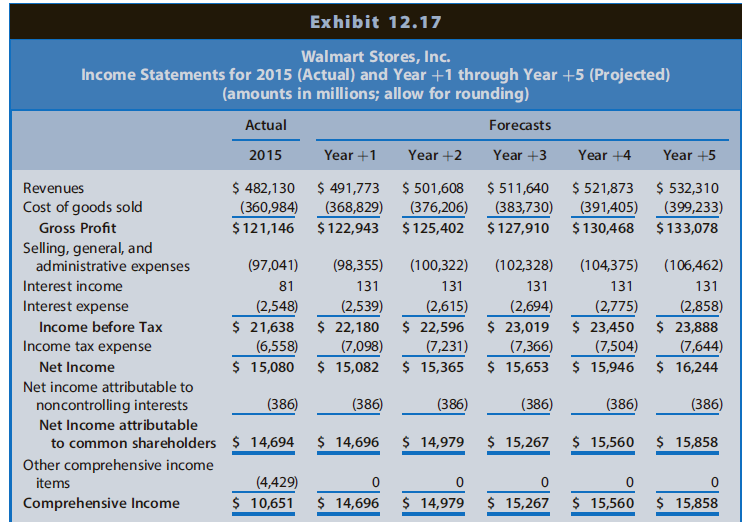

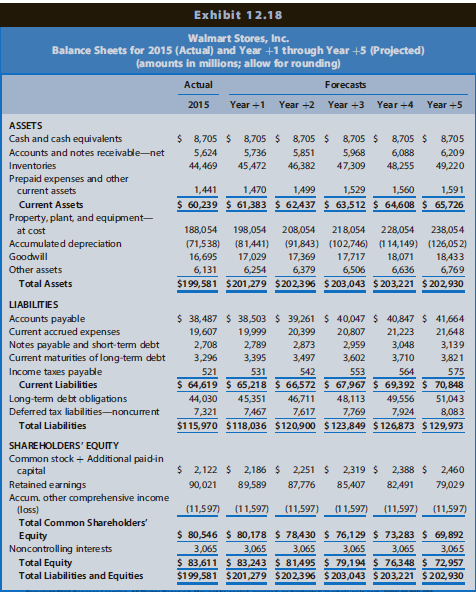

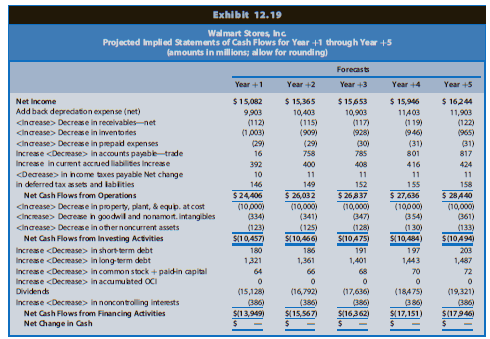

The data in Exhibits 12.17 to 12.19 include the actual amounts for fiscal 2015 and the projected amounts for Year +1 to Year +5 for the income statements, balance sheets, and statements of cash flows for Walmart (in millions). These forecast amounts assume Walmart will use implied dividends as the financial flexible account to balance the balance sheet. The market equity beta for Walmart at the end of 2015 was 1.00. Assume that the risk free interest rate was 3.0% and the market risk premium was 6.0%. Walmart had 3,162 million shares outstanding at the end of fiscal 2015, and a share price of $67.50.

REQUIRED

Part I

Computing Walmart's Share Value Using Free Cash Flows to Common Equity Shareholders

a. Use the CAPM to compute the required rate of return on common equity capital for Walmart.

b. Beginning with projected net cash flows from operations, derive the projected free cash flows for common equity shareholders for Walmart for Years +1 through +5 based on the projected financial statements. Assume that Walmart uses cash for operating liquidity purposes.

c. Project the continuing free cash flow for common equity shareholders in Year +6. Assume that the steady-state, long-run growth rate will be 3% in Year +6 and beyond. Project that the Year +5 income statement and balance sheet amounts will grow by 3% in Year +6; then derive the projected statement of cash flows for Year +6. Derive the projected free cash flow for common equity shareholders in Year +6 from the projected statement of cash flows for Year +6.d. Using the required rate of return on common equity from Requirement a as the discount rate, compute the sum of the present value of free cash flows for common equity shareholders for Walmart for Years +1 through +5.e. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirement c, compute the continuing value of Walmart as of the start of Year +6 based on Walmart's continuing free cash flows for common equity shareholders in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value at the start of Year +1.f. Compute the value of a share of Walmart common stock.

c. Project the continuing free cash flow for common equity shareholders in Year +6. Assume that the steady-state, long-run growth rate will be 3% in Year +6 and beyond. Project that the Year +5 income statement and balance sheet amounts will grow by 3% in Year +6; then derive the projected statement of cash flows for Year +6. Derive the projected free cash flow for common equity shareholders in Year +6 from the projected statement of cash flows for Year +6.d. Using the required rate of return on common equity from Requirement a as the discount rate, compute the sum of the present value of free cash flows for common equity shareholders for Walmart for Years +1 through +5.e. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirement c, compute the continuing value of Walmart as of the start of Year +6 based on Walmart's continuing free cash flows for common equity shareholders in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value at the start of Year +1.f. Compute the value of a share of Walmart common stock.

(1) Compute the total sum of the present value of all future free cash flows for equity shareholders (from Requirements d and e).

(2) Adjust the total sum of the present value using the midyear discounting adjustment factor.

(3) Compute the per-share value estimate.

Part II

Computing Walmart's Share Value Using Free Cash Flows to All Debt and Equity Stakeholders

g. Compute the weighted-average cost of capital for Walmart as of the start of Year +1. At the end of fiscal 2015, Walmart had $50,034 million in outstanding interest bearing debt on the balance sheet and no preferred stock. Assume that the balance sheet value of Walmart's debt is approximately equal to the market value of the debt. Assume that at the start of Year +1, Walmart will incur interest expense of 5.0% on debt capital and that Walmart's average tax rate will be 32.0%. In addition, at the end of fiscal 2015, Walmart had non controlling interests of $3,065 million, with an expected return of 12.6%. (For our forecasts, we assume non controlling interests receive dividends equal to the required rate of return each year.)

h. Beginning with projected net cash flows from operations, derive the projected free cash flows for all debt and equity Stakeholders for Walmart for Years +1 through +5 based on the projected financial statements.

i. Project the continuing free cash flows for all debt and equity Stakeholders in Year +6. Use the projected financial statements for Year +6 from Requirement c to derive the projected free cash flow for all debt and equity Stakeholders in Year +6.j. Using the weighted-average cost of capital from Requirement g as a discount rate, compute the sum of the present value of free cash flows for all debt and equity Stakeholders for Walmart for Years +1 through +5.k. Using the weighted-average cost of capital from Requirement g as a discount rate and the long-run growth rate from Requirement c, compute the continuing value of Walmart as of the start of Year +6 based on Walmart's continuing free cash flows for all debt and equity Stakeholders in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value as of the start of Year +1.

l. Compute the value of a share of Walmart common stock.

(1) Compute the total value of Walmart's net operating assets using the total sum of the present value of free cash flows for all debt and equity Stakeholders (from Requirements j and k).

(2) Subtract the value of outstanding debt to obtain the value of equity.

(3) Adjust the present value of equity using the midyear discounting adjustment factor.

(4) Compute the per-share value estimate of Walmart's common equity shares.

Do not be alarmed if your share value estimate from Requirement f is slightly different from your share value estimate from Requirement l. The weighted-average cost of capital computation in Requirement g used the weight of equity based on the market price of Walmart's stock at the end of fiscal 2015. The share value estimates from Requirements f and l likely differ from the market price, so the weights used to compute the weighted-average cost of capital are not internally consistent with the estimated share values.

Part III

Sensitivity Analysis and Recommendation

m. Using the free cash flows to common equity shareholders, recompute the value of Walmart shares under two alternative scenarios.

Scenario 1: Assume that Walmart's long-run growth will be 2%, not 3% as before, and assume that Walmart's required rate of return on equity is one percentage point higher than the rate you computed using the CAPM in Requirement a.

Scenario 2: Assume that Walmart's long-run growth will be 4%, not 3% as before, and assume that Walmart's required rate of return on equity is one percentage point lower than the rate you computed using the CAPM in Requirement a. To quantify the sensitivity of your share value estimate for Walmart to these variations in growth and discount rates, compare (in percentage terms) your value estimates under these two scenarios with your value estimate from Requirement f.

n. Using these data at the end of fiscal 2015, what reasonable range of share values would you have expected for Walmart common stock? At that time, what was the market price for Walmart shares relative to this range? What would you have recommended?

Exhibit 12.17 Walmart Stores, Inc. Income Statements for 2015 (Actual) and Year +1 through Year +5 (Projected) (amounts in millions; allow for rounding) Actual Forecasts 2015 Year +1 Year +2 Year +3 Year +4 Year +5 $ 482,130 (360,984) $ 121,146 $ 491,773 (368,829) $ 501,608 (376,206) $ 125,402 $ 511,640 (383,730) $ 127,910 $ 521,873 (391,405) $ 532,310 (399,233) Revenues Cost of goods sold Gross Profit $ 122,943 $ 130,468 $ 133,078 Selling, general, and administrative expenses (97,041) (98,355) (100,322) (102,328) (104,375) (106,462) Interest income 81 131 131 131 131 131 Interest expense (2,548) (2,539) (2,615) (2,694) (2,775) (2,858) $ 21,638 (6,558) $ 22,180 (7,098) $ 22,596 (7,231) $ 23,019 (7,366) $ 23,450 (7,504) $ 23,888 (7,644) $ 16,244 Income before Tax Income tax expense Net Income $ 15,080 $ 15,082 $ 15,365 $ 15,653 $ 15,946 Net income attributable to noncontrolling interests (386) (386) (386) (386) (386) (386) Net Income attributable to common shareholders $ 14,694 $ 14,696 $ 14,979 $ 15,267 $ 15,560 $ 15,858 Other comprehensive income items (4,429) Comprehensive Income $ 10,651 $ 14,696 $ 14,979 $ 15,267 $ 15,560 $ 15,858

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

The market equity beta for Walmart at the end of 2015 is 100 Assume that the riskfree interest rate is 30 and the market risk premium is 60 Walmart has 3162 million shares outstanding at the end of 20... View full answer

Get step-by-step solutions from verified subject matter experts