Question: Princeton Ltd provides a defined benefit superannuation plan for its managers. The assistant accountant has completed some sections of the defined benefit worksheet based on

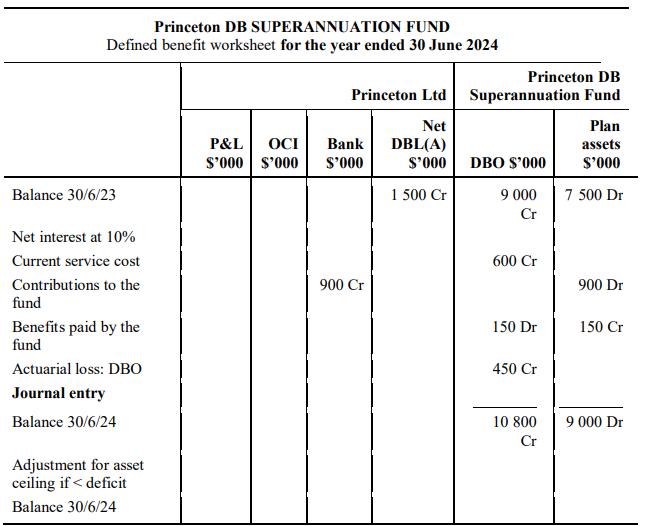

Princeton Ltd provides a defined benefit superannuation plan for its managers. The assistant accountant has completed some sections of the defined benefit worksheet based on information provided in an actuary’s report on the Princeton DB Superannuation Fund for the year ended 30 June 2024.

The asset ceiling was \($900\) 000 at 30 June 2024.

Required

1. Determine the surplus or deficit of the fund at 30 June 2024.

2. Determine the net defined benefit asset or liability at 30 June 2024.

3. Calculate the net interest and distinguish between the interest expense component of the defined benefit obligation and the interest income component of the change in the fair value of plan assets for the year ended 30 June 2024.

4. Determine the amount to be recognised in profit or loss in relation to the defined benefit superannuation plan for the year ended 30 June 2024.

5. Determine the amount to be recognised in other comprehensive income in relation to the defined benefit superannuation plan for the year ended 30 June 2024.

Princeton DB SUPERANNUATION FUND Defined benefit worksheet for the year ended 30 June 2024 Princeton DB Princeton Ltd Superannuation Fund Balance 30/6/23 Net Plan P&L OCI Bank DBL(A) assets S'000 $'000 $'000 $'000 DBO $'000 $'000 1 500 Cr 9.000 Cr 7 500 Dr Net interest at 10% Current service cost 600 Cr Contributions to the 900 Cr 900 Dr fund Benefits paid by the 150 Dr 150 Cr fund Actuarial loss: DBO 450 Cr Journal entry Balance 30/6/24 Adjustment for asset ceiling if

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

1 1 800 000 deficit 2 The net defined benefi... View full answer

Get step-by-step solutions from verified subject matter experts