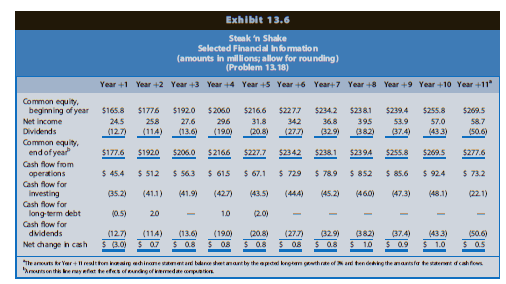

Question: Problem 13.18 and Exhibit 13.6 in Chapter 13 present selected hypothetical data from projected financial statements for Steak 'n Shake for Year +1 to Year

Problem 13.18 and Exhibit 13.6 in Chapter 13 present selected hypothetical data from projected financial statements for Steak 'n Shake for Year +1 to Year +11. The amounts for Year +11 reflect a long-term growth assumption of 3%. The cost of equity capital is 9.34%. The market value of common shareholders' equity in Steak 'n Shake on January 1, Year +1, is $309.98 million.

REQUIREDa. Compute the value-to-book ratio as of January 1, Year +1, using the residual ROCE valuation method.b. Using the analyses developed in Requirement a, prepare an exhibit summarizing the following ratios for Steak 'n Shake as of January 1, Year +1:1. Value-to-book ratio (using the amounts from Requirement a)2. Market-to-book ratio3. Value-earnings ratio, using reported earnings for Year 0 of $21.8 million4. Price-earnings ratio, using reported earnings for Year 0 of $21.8 million5. Value-earnings ratio, using projected earnings for Year +1 of $24.5 million6. Price-earnings ratio, using projected earnings for Year +1 of $24.5 millionc. Use reverse engineering to solve for the long-run growth rate in continuing residual income in Year +11 and beyond that is implicitly impounded in the market value of Steak 'n Shake on January 1, Year +1. Use the 9.34% cost of equity capital and the projected earnings amounts for Year +1 to Year +10 in Exhibit 13.6 before solving for the long-run growth rate in continuing residual income.d. Using the analyses in Requirements a-c, evaluate the extent of the market's mispricing (if any) of Steak 'n Shake

Exhibit 13.6 Steak 'n Shake Selected Financial Info mation (amounts in millions; allow for rounding) (Problem 13.18) Year +1 Year +2 Year +3 Year +4 Year +5 Year +6 Year+7 Year +8 Year +9 Year +10 Year +11 Common equity, beginning of year $165.8 $1776 $192.0 $2060 $216.6 $2277 $234.2 $2381 $239.4 $255.8 $269.5 53.9 (37.4) 24.5 258 (114) 31.8 (20.8) 36.8 (32.9) Net income 27.6 296 342 395 57.0 58.7 Dividends (12.7) (13.6) (190) (277) (382) (43.3) (50.6) Common equity. endof year $177.6 $1920 $206.0 $2166 $227.7 $2342 $238.1 $2394 $255.8 $269.5 $277.6 Cash flow from operations Cash flow for Investing $ 45.4 $ 512 $ 56.3 $ 615 $ 67.1 $ 729 $ 78.9 $ 852 $ 85.6 $ 924 $ 73.2 (35.2) (41.1) (41.9) (427) (43.5) (444) (45.2) (460) (47.3) (48.1) (22.1) Cash flow for lang term debt Cash flow for dividends (0.5) 20 10 (2.0) (37.4) $ 0.9 (43 3) (12.7) (3.0) (114) (13.6) (190) (20.8) (27.7) (32.9) (382) (50.6) Net change in cash $ 07 0.8 08 0.8 08 0.8 10 1.0 0.5 "The aruts kr Yar +l realtton inaairg ahiname tametand badane dhet anant by the apded keotm th rae of ard ten deing the anantsta te tat dcahfows Arantson th eray efat teefas of ofmedae onparkn

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

To tackle these tasks lets break down each requirement step by step Requirement a Compute the ValuetoBook Ratio Using the Residual ROCE Valuation Meth... View full answer

Get step-by-step solutions from verified subject matter experts