Big-Deal Construction Company specializes in building dams. During Years 3, 4, and 5, three dams were completed.

Question:

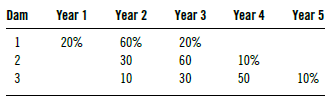

Big-Deal Construction Company specializes in building dams. During Years 3, 4, and 5, three dams were completed. The first dam was started in Year 1 and completed in Year 3 at a profit before income taxes of $120,000. The second and third dams were started in Year 2. The second dam was completed in Year 4 at a profit before income taxes of $126,000, and the third dam was completed in Year 5 at a profit before income taxes of $150,000. The company uses percentage of-completion accounting for financial reporting and the completed-contract method of accounting for income tax purposes. The applicable income tax rate is 50% for each of the Years 1 through 5. Data relating to progress toward completion of work on each dam as reported by the company?s engineers are given here:

Required:

For each of the five years, Year 1 through Year 5, compute:

a. Financial reporting (book) income.

b. Taxable income.

c. Change in deferred income taxes.

Step by Step Answer:

Financial Statement Analysis

ISBN: 978-0073379432

10th edition

Authors: K. R. Subramanyam, John J. Wild