A Canadian pension fund manager seeks to measure the sensitivity of her pension liabilities to market interest

Question:

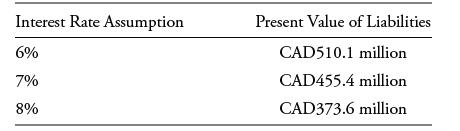

A Canadian pension fund manager seeks to measure the sensitivity of her pension liabilities to market interest rate changes. The manager determines the present value of the liabilities under three interest rate scenarios: a base rate of 7%, a 100 basis point increase in rates up to 8%, and a 100 basis point drop in rates down to 6%. The results of the manager’s analysis are presented below:

The effective duration of the pension fund’s liabilities is closest to:

A. 1.49.

B. 14.99.

C. 29.97.

Transcribed Image Text:

Interest Rate Assumption 6% 7% 8% Present Value of Liabilities CAD510.1 million CAD455.4 million CAD373.6 million

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The effective duration of a bond is a measure of its price sensitivity to changes in interest rates ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Defined-benefit pension schemes typically pay retirees a monthly amount based on their wage level at the time of retirement. The amount could be fixed in nominal terms or indexed to inflation. These...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

In Problem, p is the price per unit in dollars and q is the number of units. If the weekly demand function is p = 30 - q and the supply function before taxation is p = 6 + 2q, what tax per item will...

-

If the calendar should not dictate reporting frequency, what should?

-

Taylor Marina has 300 available slips that rent for 800 per season. Payments must be made in full at the start of the boating season, April 1, 2015. The boating season ends October 31, and the marina...

-

Refer to the statements for Google in Appendix A. For the year ended December 31, 2015, what was its debt-to-equity ratio? What does this ratio tell us? Data From Statement Google In Appendix A...

-

The normal capacity of a factory is 8,000 units per month. Cost and production data follow: Standard application rate for fixed overhead . . . . . . . . . . . . . . . . . . $0.50 per unit Standard...

-

Assume that Twigs has hired you as a database consultant to develop it's operational database having the three tables described at the end of Chapter 6. Assume that Twigs personnel are the owner, an...

-

Which of the following statements about Macaulay duration is correct? A. A bonds coupon rate and Macaulay duration are positively related. B. A bonds Macaulay duration is inversely related to its...

-

Which of the following is most appropriate for measuring a bonds sensitivity to shaping risk? A. Key rate duration B. Effective duration C. Modified duration

-

Find two different state-variable formulations that model the system whose difference equation is given by: (a) \(y(k+2)+6 y(k+1)+5 y(k)=2 e(k)\) (b) \(y(k+2)+6 y(k+1)+5 y(k)=e(k+1)+2 e(k)\) (c)...

-

4. A lens has a strong spherical aberration. If an object consists of a series of dots arranged in a cross concentric with the optical axis (Fig. 1), how does the image look like in the imaging...

-

(A) Consider a particle in one dimension in the presence of a potential V = a|x|; a > 0. The potential is infinite for x 0. Using WKB approximation find its energy. [note: the potential is with no...

-

3. A battery-powered toy travelling at 2.2 m/s drives off a diving board which is at a height above the water. If the impact speed of the toy is 7.3m/s, find the height of the diving board above the...

-

The lowest resonant frequency, in a certain string clamped at both ends, is 50 Hz. When the string is clamped at its midpoint, what is the lowest resonant frequency? (Ans: 100 Hz)

-

Let's say an object moves along the x - axis with the following velocity given as, vx(t) = (a +43 t - 3y ++ 76 t5), where a, , y, and 8 are just constants. (A) Determine an expression for the...

-

Thermal Technology, Inc. manufactures a special chemical used to coat certain electrical components that will be exposed to high heat in various applications. The companys annual fixed production...

-

How has the globalization of firms affected the diversity of their employees? Why has increased diversity put an additional burden on accounting systems?

-

The market portfolio has an expected return of 11 percent and a standard deviation of 19 percent. The risk-free rate is 3.2 percent. a. What is the expected return on a well-diversified portfolio...

-

A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7 percent and a standard deviation of 12 percent. The risk-free rate is 2.7 percent, and the expected...

-

Suppose the risk-free rate is 2.1 percent and the market portfolio has an expected return of 10.6 percent. The market portfolio has a variance of .0432. Portfolio Z has a correlation coefficient with...

-

Reviewing the statement of cash flows of KRJ Enterprises (all figures in $ millions), you find the following items: net cash flow from operating activities of $772, net cash flow from investing...

-

The beginning-of-the-year fund balance was $159,160. Estimated and actual Other Financing UsesInterfund Transfers Out totaled $50,900. Required From the ledger detail, reproduce the summary journal...

-

Flew cargo for two customers from Dallas to Albuquerque for $3,800; one customer paid $1,000 cash and the other asked to be billed. how would this be recorded on a journal entry?

Study smarter with the SolutionInn App