Defined-benefit pension schemes typically pay retirees a monthly amount based on their wage level at the time

Question:

Defined-benefit pension schemes typically pay retirees a monthly amount based on their wage level at the time of retirement. The amount could be fixed in nominal terms or indexed to inflation. These programs are referred to as “defined-benefit pension plans” when US GAAP or IFRS accounting standards are used. In Australia, they are called “superannuation funds.”

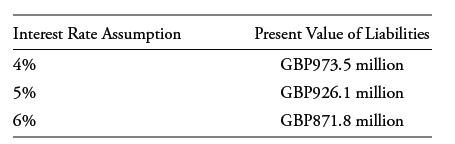

A British defined-benefit pension scheme seeks to measure the sensitivity of its retirement obligations to market interest rate changes. The pension scheme manager hires an actuarial consultancy to model the present value of its liabilities under three interest rate scenarios: (1) a base rate of 5%, (2) a 100 bp increase in rates, up to 6%, and (3) a 100 bp drop in rates, down to 4%.

The actuarial consultancy uses a complex valuation model that includes assumptions about employee retention, early retirement, wage growth, mortality, and longevity. The following chart shows the results of the analysis.

Compute the effective duration of the pension scheme’s liabilities.

Step by Step Answer: