A consultant for a large corporate pension plan is looking at three funds (Funds X, Y, and

Question:

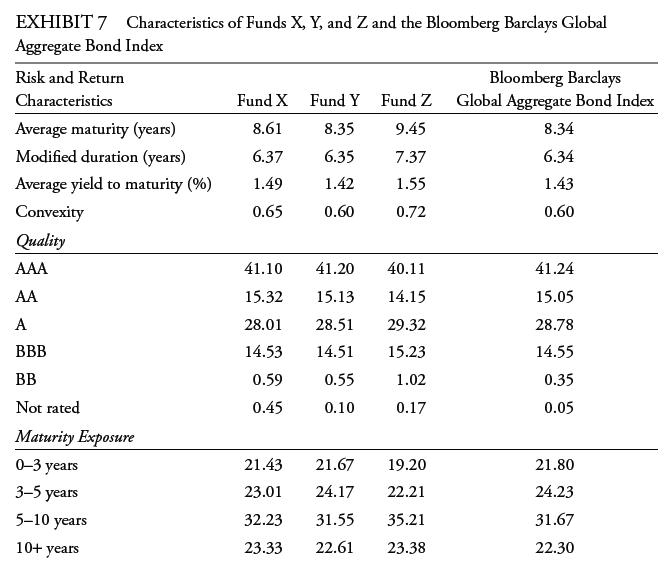

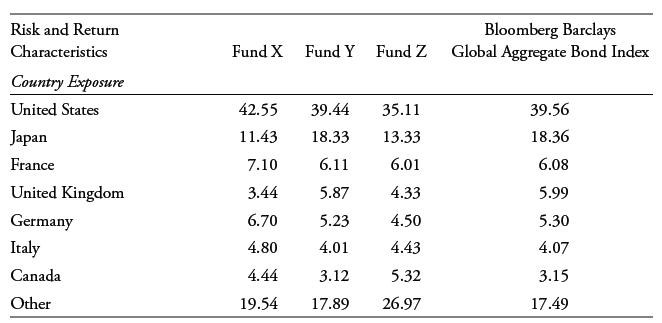

A consultant for a large corporate pension plan is looking at three funds (Funds X, Y, and Z) as part of the pension plan’s global fixed-income allocation. All three funds use the Bloomberg Barclays Global Aggregate Bond Index as a benchmark. Exhibit 7 provides characteristics of each fund and the index. Identify the approach (pure indexing, enhanced indexing, or active management) that is most likely used by each fund and support your choices by referencing the information in Exhibit 7.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: