A fixed-income manager is presented with the following key rate duration summary of his actively managed bond

Question:

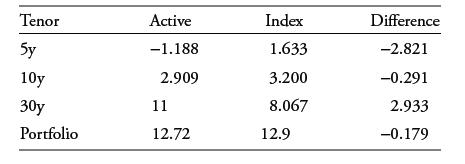

A fixed-income manager is presented with the following key rate duration summary of his actively managed bond portfolio versus an equally weighted index portfolio across 5-, 10-, and 30-year maturities:

Assume the active manager has invested in the index bond portfolio and used only derivatives to create the active portfolio. Which of the following most likely represents the manager’s synthetic positions?

a. Receive-fixed 5-year swap, short 10-year futures, and pay-fixed 30-year swap

b. Pay-fixed 5-year swap, short 10-year futures, and receive-fixed 30-year swap

c. Short 5-year futures, long 10-year futures, and receive-fixed 30-year swap

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: