Question: Say a UK-based manager seeks to extend duration beyond an index by adding 10-year exposure. The manager considers either buying and holding a 10-year, 2.25%

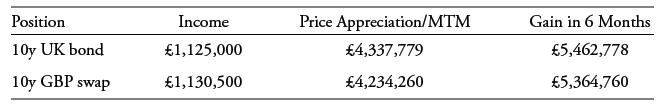

Say a UK-based manager seeks to extend duration beyond an index by adding 10-year exposure. The manager considers either buying and holding a 10-year, 2.25% semi-annual coupon UK government bond priced at ₤93.947, with a corresponding yield-to-maturity of 2.9535%, or entering a new 10-year, GBP receive-fixed interest rate swap at 2.8535% versus the six-month GBP MRR currently set at 0.5925%. We compare the results of both strategies over a six-month time horizon for a ₤100 million par value during which both the bond yield-to-maturity and swap rates fall 50 bps. We ignore day count details in the calculation.

Position 10y UK bond 10y GBP swap Income 1,125,000 1,130,500 Price Appreciation/MTM 4,337,779 4,234,260 Gain in 6 Months 5,462,778 5,364,760

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

The relevant return components from Equation 1 are income namely coupon income for the bond versus c... View full answer

Get step-by-step solutions from verified subject matter experts