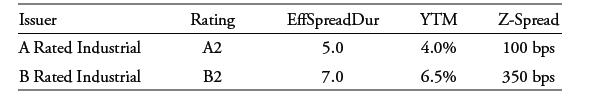

A portfolio manager considers two industrial bonds for a one-year investment: The manager observes a historical annual

Question:

A portfolio manager considers two industrial bonds for a one-year investment:

The manager observes a historical annual default probability of 0.27% for A2 rated issuers and 3.19% for B2 rated issuers and assumes a 40% recovery rate for both bonds.

Compute the estimated excess return for each bond assuming no change in spreads, and interpret whether the B rated bond spread provides sufficient compensation for the incremental risk.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: