A United Statesbased issuer has the following option-free bonds outstanding: Current on-the-run US Treasury YTMs are as

Question:

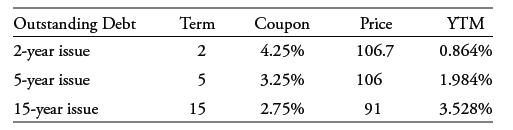

A United States–based issuer has the following option-free bonds outstanding:

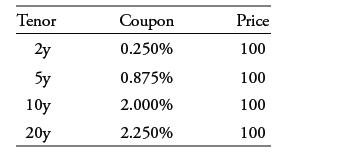

Current on-the-run US Treasury YTMs are as follows:

An investor considers the purchase of a new 10-year issue from the company and expects the new bond to include a 10 bp new issue premium. What is the fair value spread for the new issue based on outstanding debt?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: