An investment fund owns the following portfolio of three fixed-rate government bonds: The total market value of

Question:

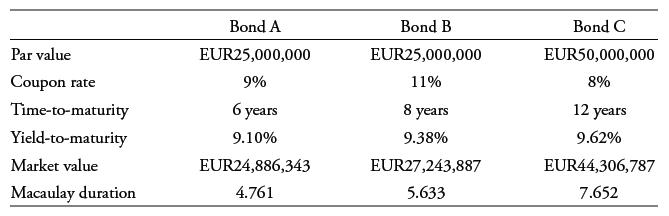

An investment fund owns the following portfolio of three fixed-rate government bonds:

The total market value of the portfolio is EUR96,437,017. Each bond is on a coupon date so that there is no accrued interest. The market values are the full prices given the par value. Coupons are paid semiannually. The yields-to-maturity are stated on a semiannual bond basis, meaning an annual rate for a periodicity of 2. The Macaulay durations are annualized.

Estimate the percentage loss in the portfolio’s market value if the (annual) yield-to-maturity on each bond goes up by 20 bps.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: