An investment fund owns the following portfolio of three fixed-rate government bonds: The total market value of

Question:

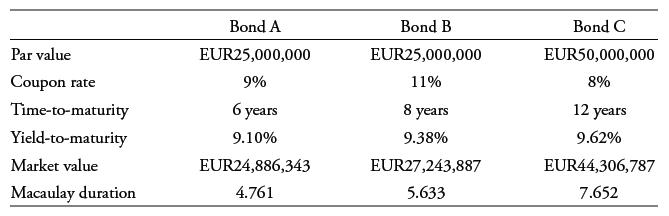

An investment fund owns the following portfolio of three fixed-rate government bonds:

The total market value of the portfolio is EUR96,437,017. Each bond is on a coupon date so that there is no accrued interest. The market values are the full prices given the par value. Coupons are paid semiannually. The yields-to-maturity are stated on a semiannual bond basis, meaning an annual rate for a periodicity of 2. The Macaulay durations are annualized.

Calculate the average (annual) modified duration for the portfolio using the shares of market value as the weights.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: