An investor is considering the following six annual coupon payment government bonds: Based on the relationships between

Question:

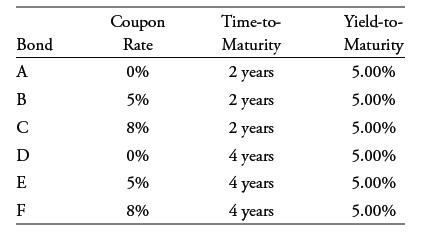

An investor is considering the following six annual coupon payment government bonds:

Based on the relationships between the bond prices and bond characteristics, which bond will go down in price the least on a percentage basis if all yields go up from 5.00% to 5.10%?

Transcribed Image Text:

Bond A B C D E F Coupon Rate 0% 5% 8% 0% 5% 8% Time-to- Maturity 2 years 2 years 2 years 4 years 4 years 4 years Yield-to- Maturity 5.00% 5.00% 5.00% 5.00% 5.00% 5.00%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Bond C will go down in price the least on a percentage ...View the full answer

Answered By

Tobias sifuna

I am an individual who possesses a unique set of skills and qualities that make me well-suited for content and academic writing. I have a strong writing ability, allowing me to communicate ideas and arguments in a clear, concise, and effective manner. My writing is backed by extensive research skills, enabling me to gather information from credible sources to support my arguments. I also have critical thinking skills, which allow me to analyze information, draw informed conclusions, and present my arguments in a logical and convincing manner. Additionally, I have an eye for detail and the ability to carefully proofread my work, ensuring that it is free of errors and that all sources are properly cited. Time management skills are another key strength that allow me to meet deadlines and prioritize tasks effectively. Communication skills, including the ability to collaborate with others, including editors, peer reviewers, and subject matter experts, are also important qualities that I have. I am also adaptable, capable of writing on a variety of topics and adjusting my writing style and tone to meet the needs of different audiences and projects. Lastly, I am driven by a passion for writing, which continually drives me to improve my skills and produce high-quality work.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Ray wishes to determine the optimal order quantity for its best-selling bike in his bike store. Ray pays the supplier a wholesale price of $80 each for this bike. Ray has estimated the average daily...

-

An investor is considering the following six annual coupon payment government bonds: Based on the relationships between bond prices and bond characteristics, which bond will go up in price the most...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Read the case study of Ritz Carlton Company USA and discuss why and how you would transfer some of their methods to the operation of a non-accommodation component in an integrated resort complex.

-

In what sense is the interest coverage ratio more a measure for assessing short-term liquidity risk than it is a measure for assessing long-term solvency risk?

-

Estimate the final speed \(v\) of the charged particle in Figure 30.8 in terms of the speed of propagation \(c\) of the electromagnetic wave pulse produced by the particle's acceleration. Figure 30.8...

-

What is the Personnel-Equipment Interactions Model?

-

Beantown Baseball Company makes baseballs that sell for $13.00 per two-pack. Current annual production and sales are 960,000 baseballs. Costs for each baseball are as follows: Direct material...

-

What is force? What are three laws of Newton? Give one example of each from your life where you may use them?

-

Suppose that an investor observes the following prices and yields-to-maturity on zerocoupon government bonds: The prices are per 100 of par value. The yields-to-maturity are stated on a semiannual...

-

An analyst observes these reported statistics for two bonds. The analyst believes that Bond B has a little more risk than Bond A. How much additional compensation, in terms of a higher...

-

How should you organize a letter in response to an announced job opening?

-

Consumers who want to eat fresh, local produce and small farmers looking for more predictable revenue have found a match in community-supported agriculture (CSA). CSA is essentially a subscription...

-

Find the centroid of a rod of length L, and mass M, using the first principle.

-

Research and write a short paper (two pages maximum) describing how organizations use aggregate planning options in Exhibit 14.3. EXHIBIT 14.3 Example Aggregate Planning Variables and Revenue/Cost...

-

Looking independently at each of the economic observations below, indicate the country where an analyst would expect to see a strengthening currency for each observation. Expected inflation over next...

-

Marcus begins trading on 1 January 2016 and has the following results: (a) Compute his trading income (before loss relief) for 2015-16 to 2017-18. (b) Identify the claims that could be made in...

-

What is the difference between Chapter 7 and Chapter 13 bankruptcies?

-

What do you think?

-

Discuss how output from a marketing information system (MIS) might differ from the output of a typical marketing research department.

-

Discuss some of the likely problems facing the marketing manager in a small firm who plans to search the Internet for information on competitors marketing plans.

-

Explain the key characteristics of the scientific method and show why these are important to managers concerned with research.

-

Suppose a stock has generated the following annual returns: 1 4 . 6 % , - 1 4 . 3 % and 8 . 6 % . What was its total return during that period? Answer in percent, rounded to two decimal places ( e ....

-

Determine the amount of interest that will be earned on each of the following investments: (Round answers to 2 decimal places, e.g. 15.25.) (i) (n) Investment Interest Rate Number of Periods Type of...

-

1. [15] A new product is being developed by a food manufacturer. Depending on the quality of raw materials, different yields are expected, and the quality of the final products will also vary...

Study smarter with the SolutionInn App