An analyst observes these reported statistics for two bonds. The analyst believes that Bond B has a

Question:

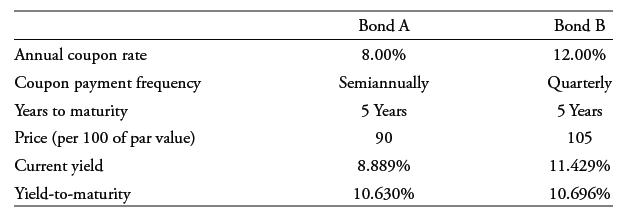

An analyst observes these reported statistics for two bonds.

The analyst believes that Bond B has a little more risk than Bond A. How much additional compensation, in terms of a higher yield-to-maturity, does a buyer of Bond B receive for bearing this risk compared with Bond A?

Transcribed Image Text:

Annual coupon rate Coupon payment frequency Years to maturity Price (per 100 of par value) Current yield Yield-to-maturity Bond A 8.00% Semiannually 5 Years 90 8.889% 10.630% Bond B 12.00% Quarterly 5 Years 105 11.429% 10.696%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

The yieldtomaturity on Bond A of 10630 is an annual rate for com pounding semiannually ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

An analyst observes these reported statistics for two bonds. Confirm the calculation of the two yield measures for the two bonds. Annual coupon rate Coupon payment frequency Years to maturity Price...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

O What is the transfer function of the following system? di (1) di O 2- O 4 2s+1 1 25 +5 1 2s+1 +i(1) -e (1) where initial condition is i(0)=2. 1 25 +5 + 1 25 +5 4 2s+1

-

Consider an electric motor with a shaft power output of 20 kW and an efficiency of 88 percent. Determine the rate at which the motor dissipates heat to the room it is in when the motor operates at...

-

Identify the assumptions underlying the interest coverage ratio needed to make it an appropriate measure for analyzing long-term solvency risk.

-

A firm faces an elastic demand for its product. It has come to an economist to advise it on whether to lower its price. The answer she gives is: Maybe. Why is this the right answer?

-

In 2004, Jui-Chen Lin, a citizen of China, entered into an agreement with Robert Chiu and Charles Cobb, citizens of the United States, to form an LLC to acquire and operate a fast-food restaurant in...

-

Ratio Analysis How ser Inc. is a manufacturer of electronic components and accessories with total assets of $20,000,000. Selected financial ratios for how ser and the industry averages for firms of...

-

Charles holds a one-year $1000face value, taxable bond with a coupon rate of 7%. Suppose he faces a tax rate of 32%. How much tax will he pay for income earned on the investment? And, assuming he...

-

An investor is considering the following six annual coupon payment government bonds: Based on the relationships between the bond prices and bond characteristics, which bond will go down in price the...

-

A 6% annual coupon corporate bond with two years remaining to maturity is trading at a price of 100.125. The two-year, 4% annual payment government benchmark bond is trading at a price of 100.750....

-

Fill in each blank so that the resulting statement is true. The division is performed by multiplying the numerator and denominator by____. 7 + 4i 2 - 5i

-

To succeed in international trade, it is crucial to know what to sell and how to sell a product or service. For example, a company that specializes in pork-based products would likely not find a...

-

How do ecological disturbances, such as wildfires, invasive species invasions, and disease outbreaks, interact with ecosystem structure and function, and what are the implications for ecosystem...

-

To understand both the professional and organizational identity threats at play for organizational members as they confront alternative new ways of working To explore the leadership challenges...

-

What are the socio-ecological implications of ecosystem degradation and biodiversity loss, and how can collaborative governance approaches be leveraged to promote sustainable resource use and...

-

What is the function of registers in the fetch-execute instruction cycle? What is the purpose of the instruction register? Q.9 Define the terms: Master slave multiprocessing Symmetrical...

-

Sports Drinks, Inc. began business in 2013 selling bottles of a thirst- quenching drink. Production for the first year was 104,000 bottles, and sales were 98,000 bottles. The selling price per bottle...

-

What did Lennox gain by integrating their WMS, TMS, and labor management systems?

-

How is the situation analysis different from the data collection step? Can both these steps be done at the same time to obtain answers sooner? Is this wise?

-

Distinguish between primary data and secondary data and illustrate your answer.

-

With so much secondary information now available free or at low cost over the Internet, why would a firm ever want to spend the money to do primary research?

-

capacitor in the figure below is initially uncharged and the switch, in position c, is not connected to either side of the circuit. The switch is now flipped to position a for 10 ms, then to position...

-

Use the folowing information for Exercises 3-30 through 3-32: Lenty, Tkia reneten penet abeast hand ecole atng osrehtehdnapatri that the costs for hte tanning service would primarily eb fixed but...

-

SmartiePants Corp., has reason to believe the shares of Groot Inc. is about to hit an all time low. After consulting their accounting team and a reputable analyst, they are forecasting a significant...

Study smarter with the SolutionInn App