Question: Based on Exhibit 4 and using Method 2, the correct price for Bond X is closest to: A. 97.2998. B. 109.0085. C. 115.0085. Betty Tatton

Based on Exhibit 4 and using Method 2, the correct price for Bond X is closest to:

A. 97.2998.

B. 109.0085.

C. 115.0085.

Betty Tatton is a fixed-income analyst with the hedge fund Sailboat Asset Management (SAM). SAM invests in a variety of global fixed-income strategies, including fixed-income arbitrage. Tatton is responsible for pricing individual investments and analyzing market data to assess the opportunity for arbitrage. She uses two methods to value bonds:

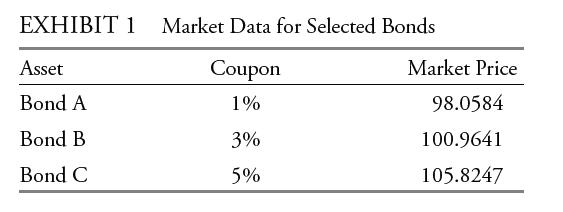

Tatton compiles pricing data for a list of annual pay bonds (Exhibit 1). Each of the bonds will mature in two years, and Tatton considers the bonds risk-free; both the one-year and twoyear benchmark spot rates are 2%. Tatton calculates the arbitrage-free prices and identifies an arbitrage opportunity to recommend to her team.

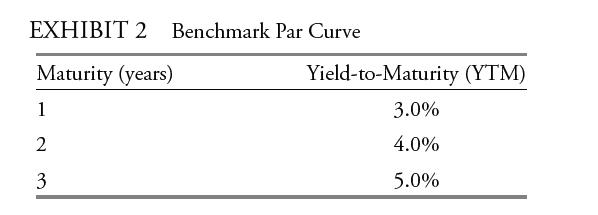

Next, Tatton uses the benchmark yield curve provided in Exhibit 2 to consider arbitrage opportunities of both option-free corporate bonds and corporate bonds with embedded options. The benchmark bonds in Exhibit 2 pay coupons annually, and the bonds are priced at par.

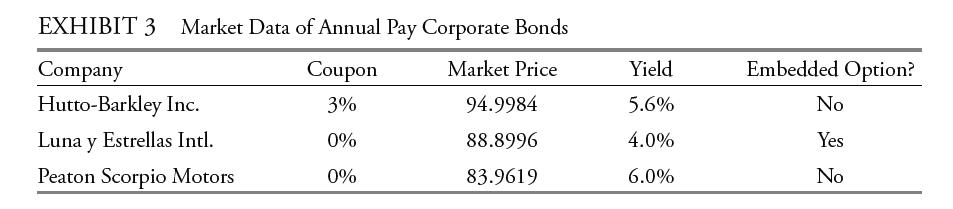

Tatton then identifies three mispriced three-year annual coupon bonds and compiles data on the bonds (see Exhibit 3).

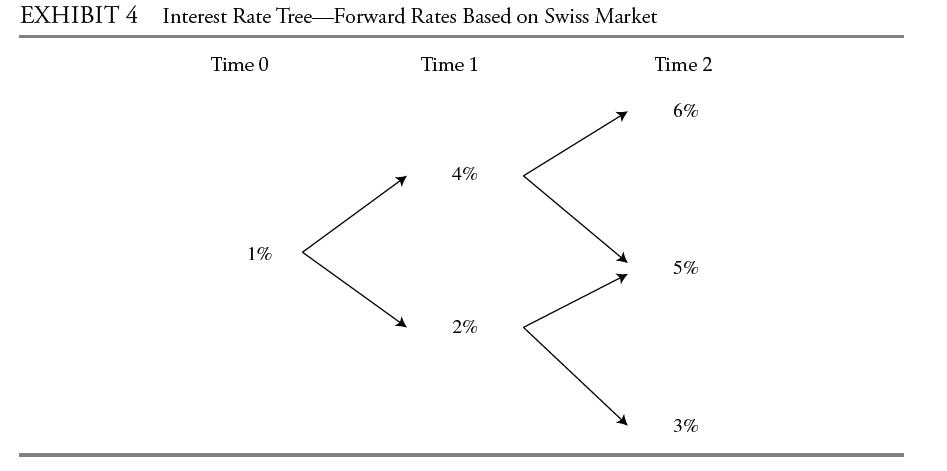

Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y, a five-year bond. Both are 6% annual coupon bonds. To calculate the bonds’ values, Tatton devises the first three years of the interest rate lognormal tree presented in Exhibit 4 using historical interest rate volatility data. Tatton considers how these data would change if implied volatility, which is higher than historical volatility, were used instead.

Method 1: Method 2: Discount each year's cash flow separately using the appropriate interest rate curve. Build and use a binomial interest rate tree.

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts