Question: 10. Based on Exhibit 4 and using Method 2, the correct price for Bond X is closest to A. 97.2998 B. 109.0085. C. 115.0085. XHIBIT

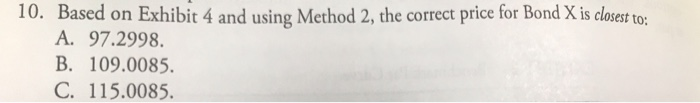

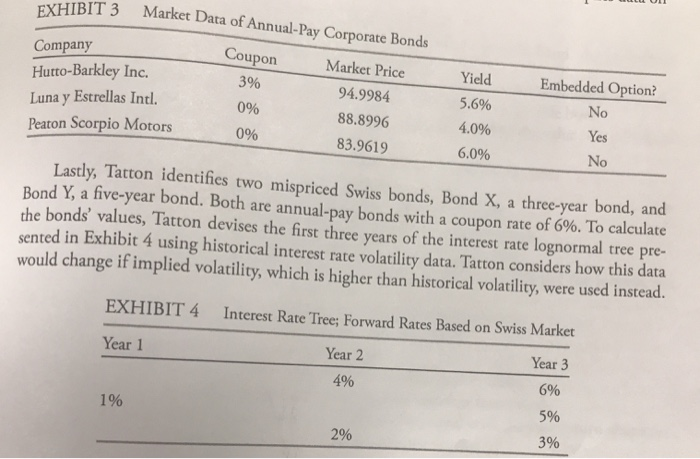

10. Based on Exhibit 4 and using Method 2, the correct price for Bond X is closest to A. 97.2998 B. 109.0085. C. 115.0085. XHIBIT 3 Market Data of Annual-Pay Corporate Bonds Company CouponMarket lPrice Hutto-Barkley Inc. Luna y Estrellas Intl. Peaton Scorpio Motors Market Price 94.9984 88.8996 83.9619 Yield 3% 0% 0% Embedded Option? No Yes No 4.0% 6.0% Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y, a five-year bond. Both are annual-pay bonds with a the bonds' values, Tatton first nted in Exhi coupon rate of 6%. To calculate devises the first three years of the interest rate lognormal tree pre bit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead. EXHIBIT 4 Interest Rate Tree; Forward Rates Based on Swiss Market Year 3 696 5% 3% Year 2 4% Year 1 196 2% 10. Based on Exhibit 4 and using Method 2, the correct price for Bond X is closest to A. 97.2998 B. 109.0085. C. 115.0085. XHIBIT 3 Market Data of Annual-Pay Corporate Bonds Company CouponMarket lPrice Hutto-Barkley Inc. Luna y Estrellas Intl. Peaton Scorpio Motors Market Price 94.9984 88.8996 83.9619 Yield 3% 0% 0% Embedded Option? No Yes No 4.0% 6.0% Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y, a five-year bond. Both are annual-pay bonds with a the bonds' values, Tatton first nted in Exhi coupon rate of 6%. To calculate devises the first three years of the interest rate lognormal tree pre bit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead. EXHIBIT 4 Interest Rate Tree; Forward Rates Based on Swiss Market Year 3 696 5% 3% Year 2 4% Year 1 196 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts