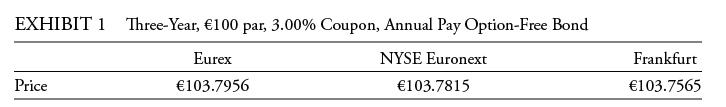

Based on Exhibits 1 and 2, the exchange that reflects the arbitrage-free price of the bond is:

Question:

Based on Exhibits 1 and 2, the exchange that reflects the arbitrage-free price of the bond is:

A. Eurex.

B. Frankfurt.

C. NYSE Euronext.

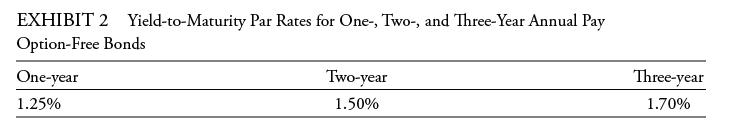

Katrina Black, a portfolio manager at Coral Bond Management, Ltd., is conducting a training session with Alex Sun, a junior analyst in the fixed-income department. Black wants to explain to Sun the arbitrage-free valuation framework used by the firm. Black presents Sun with Exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.

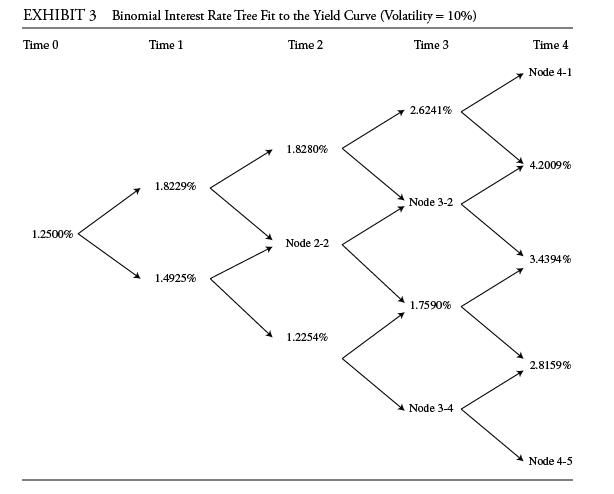

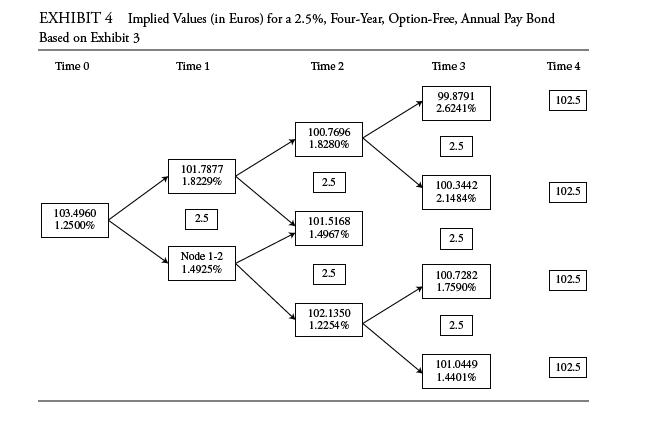

Black shows Sun some exhibits that were part of a recent presentation. Exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in Exhibit 2. Exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual pay bond with a 2.5% coupon based on the information in Exhibit 3.

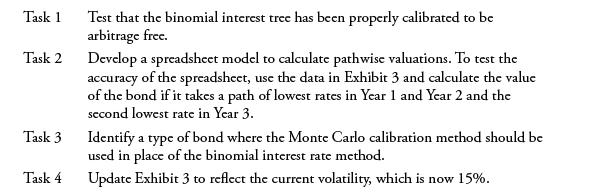

Black asks about the missing data in Exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

Step by Step Answer: