Question: Recall from the chapter that each node is represented by both a time element and a rate change component. Which of the following statements about

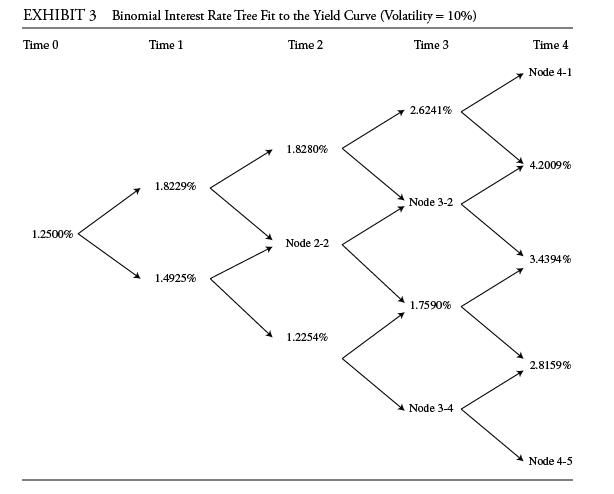

Recall from the chapter that each node is represented by both a time element and a rate change component. Which of the following statements about the missing data in Exhibit 3 is correct?

A. Node 3–2 can be derived from Node 2–2.

B. Node 4–1 should be equal to Node 4–5 multiplied by e0.4.

C. Node 2–2 approximates the implied one-year forward rate two years from now.

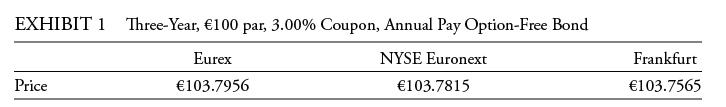

Katrina Black, a portfolio manager at Coral Bond Management, Ltd., is conducting a training session with Alex Sun, a junior analyst in the fixed-income department. Black wants to explain to Sun the arbitrage-free valuation framework used by the firm. Black presents Sun with Exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.

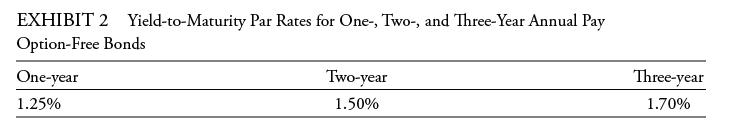

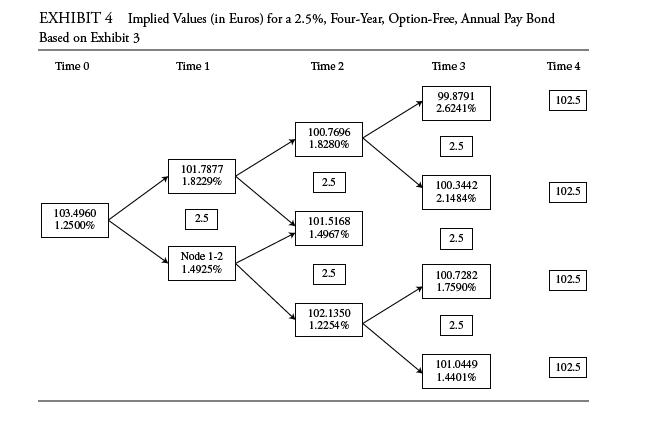

Black shows Sun some exhibits that were part of a recent presentation. Exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in Exhibit 2. Exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual pay bond with a 2.5% coupon based on the information in Exhibit 3.

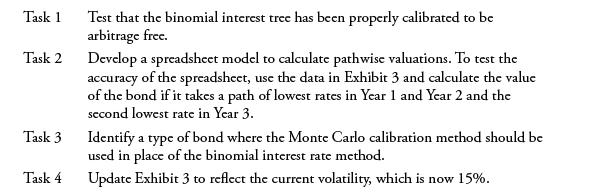

Black asks about the missing data in Exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

EXHIBIT 1 Three-Year, 100 par, 3.00% Coupon, Annual Pay Option-Free Bond Eurex NYSE Euronext 103.7956 103.7815 Price Frankfurt 103.7565

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

To determine the correct statement about the missing data in Exhibit 3 lets look at the options with respect to the provided exhibits Option A Node 32 ... View full answer

Get step-by-step solutions from verified subject matter experts