Based on Exhibits 57, in comparison to Company X, Company Y has a higher: A. Debt/capital. B.

Question:

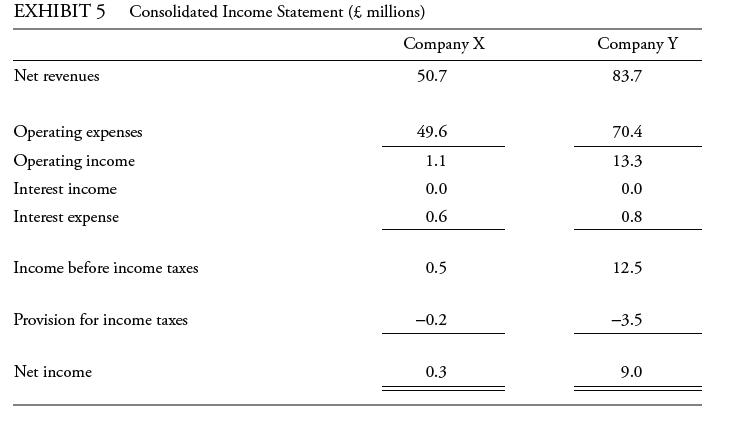

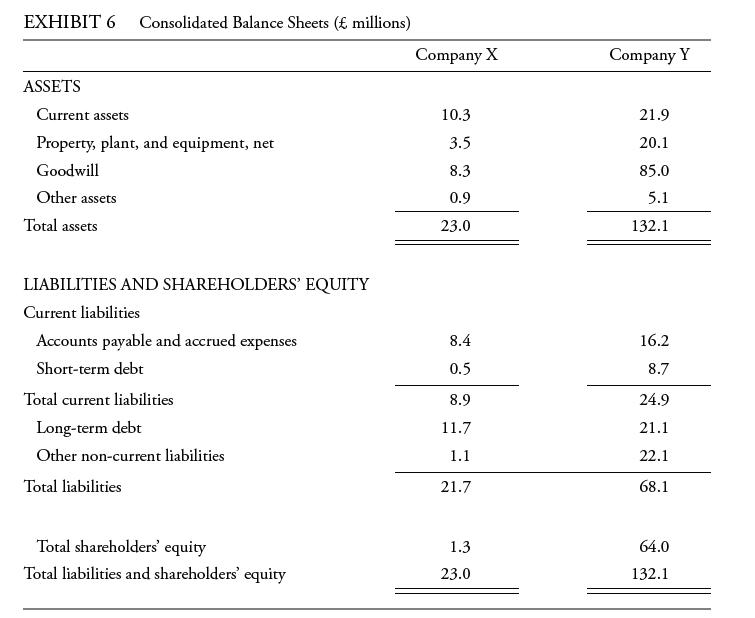

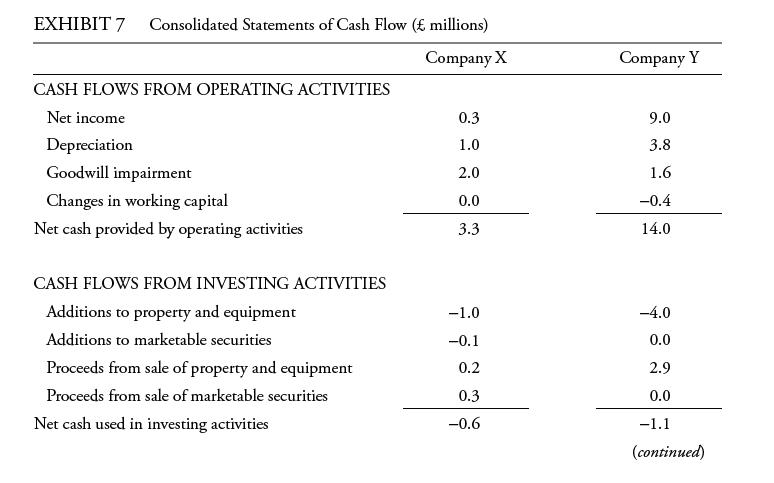

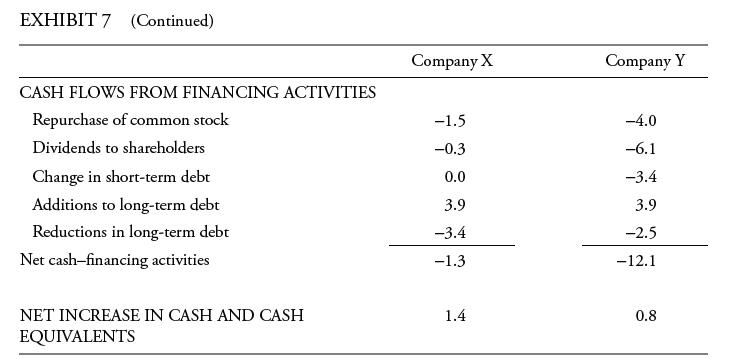

Based on Exhibits 5−7, in comparison to Company X, Company Y has a higher:

A. Debt/capital.

B. Debt/EBITDA.

C. Free cash flow after dividends/debt.

The following information relates

Transcribed Image Text:

EXHIBIT 5 Consolidated Income Statement (£ millions) Net revenues Operating expenses Operating income Interest income Interest expense Income before income taxes Provision for income taxes Net income Company X 50.7 49.6 1.1 0.0 0.6 0.5 -0.2 0.3 Company Y 83.7 70.4 13.3 0.0 0.8 12.5 -3.5 9.0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Based on Exhibits 57, in comparison to Company Y, Company X has greater: A. Leverage. B. Interest coverage. C. Operating profit margin. The following information relates EXHIBIT 5 Consolidated Income...

-

The following information relates to Costco Wholesale Corporation and Wal-Mart Stores, Inc., for their 2012 and 2011 fiscal years. Required a. Compute the following ratios for the companies 2012...

-

The following information relates to Dell City, whose first fiscal year ended December 31, 2019. Assume Dell has only the long-term debt as specified below and only the funds necessitated by the...

-

(a) For a fiber-reinforced composite, the efficiency of reinforcement ? is dependent on fiber length l according to where x represents the length of the fiber at each end that does not contribute to...

-

The following financial information is for A. Galler Company for 2009, 2008, and 2007: Required a. For 2009, 2008, and 2007, determine the following: 1. Return on assets (using end-of-year total...

-

Describe how the risk of using outdated antivirus software can be reflected in the hedge funds risk management process.

-

Increasingly, we are seeing email used in cases involving defendants located in foreign countries. Plaintiffs filed suit against four Defendants: Qingdao Sunflare New Energy Co., Skone Lighting Co.,...

-

Waterbury Corporation issued $16,000,000 in 8.5 percent, five-year bonds on March 1, 2014, at 96. The semiannual interest payment dates are September 1 and March 1. Prepare the journal entries to...

-

Which is an invalid access for the array? integer x integer array (3) numsList numsList [0] = 1 numsList [1] = 2 numsList[2] = 0 x = 3

-

Which of the following accounting issues should mostly likely be considered a character warning flag in credit analysis? A. Expensing items immediately B. Changing auditors infrequently C....

-

When determining the capacity of a borrower to service debt, a credit analyst should begin with an examination of: A. Industry structure. B. Industry fundamentals. C. Company fundamentals.

-

Kiley Corporation had these transactions during 2025. a. Purchased a machine for $30,000, giving a long-term note in exchange. b. Issued $50,000 par value common stock for cash. c. Issued $200,000...

-

Discuss the various elements of experiential marketing. In your view, why is experiential marketing a growing trend?

-

Discuss the specific issues that arise when pricing products for international markets.

-

What are the major electronic agency laws?

-

Select one influencer or celebrity that you follow online. Describe how they have used marketing to build their brand.

-

Identify two examples of organizations that you consider provide customer value, and describe how they do it.

-

Watson Inc., a multinational company, has operating divisions in France, Mexico, and Japan as well as in the United States. The company reported the following information on its consolidated...

-

What is the difference between the straight-line method of depreciation and the written down value method? Which method is more appropriate for reporting earnings?

-

What are transferred-in costs?

-

Why is it likely that Wrigley uses a process costing system rather than a job costing system?

-

Explain the difference between physical units and equivalent units.

-

Can you elaborate on the role of cultural competency in effectively navigating diverse environments?

-

Using the inputs below, find the required return on a firm's stock, also known as the cost of equity (Your answer should be with three significant digits right of decimal.) TRF M= RPM b= r= 2.000%...

-

Ethics play an important role in an organization's success. What, in your opinion, are the essential factors that an organization must keep in mind to uphold its ethical values, and how can the...

Study smarter with the SolutionInn App