Daniela Ibarra is a senior analyst in the fixed-income department of a large wealth management firm. Marten

Question:

Daniela Ibarra is a senior analyst in the fixed-income department of a large wealth management firm. Marten Koning is a junior analyst in the same department, and David Lok is a member of the credit research team.

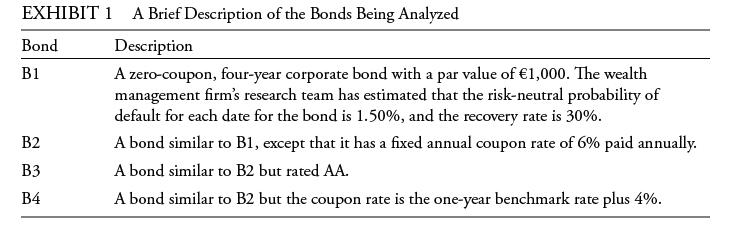

The firm invests in a variety of bonds. Ibarra is presently analyzing a set of bonds with some similar characteristics, such as four years until maturity and a par value of €1,000. Exhibit 1 includes details of these bonds.

Ibarra asks Koning to assist her with analyzing the bonds. She wants him to perform the analysis with the assumptions that there is no interest rate volatility and that the government bond yield curve is flat at 3%.

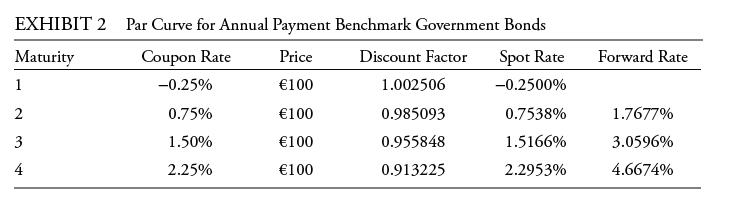

Ibarra performs the analysis assuming an upward-sloping yield curve and volatile interest rates. Exhibit 2 provides the data on annual payment benchmark government bonds.

She uses these data to construct a binomial interest rate tree based on an assumption of future interest rate volatility of 20%.

Answer the first five questions (1–5) based on the assumptions made by Marten Koning, the junior analyst. Answer Questions 8–12 based on the assumptions made by Daniela Ibarra, the senior analyst.

All calculations in this problem set are carried out on spreadsheets to preserve precision. The rounded results are reported in the solutions.

The final question for Lok is about covered bonds. The person asking says, “I’ve heard about them but don’t know what they are.” Which statement is Lok most likely to make to describe a covered bond?

A. A covered bond is issued in a non-domestic currency. The currency risk is then fully hedged using a currency swap or a package of foreign exchange forward contracts.

B. A covered bond is issued with an attached credit default swap. It essentially is a “riskfree” government bond.

C. A covered bond is a senior debt obligation giving recourse to the issuer as well as a predetermined underlying collateral pool, often commercial or residential mortgages.

Step by Step Answer: