Daniela Ibarra is a senior analyst in the fixed-income department of a large wealth management firm. Marten

Question:

Daniela Ibarra is a senior analyst in the fixed-income department of a large wealth management firm. Marten Koning is a junior analyst in the same department, and David Lok is a member of the credit research team.

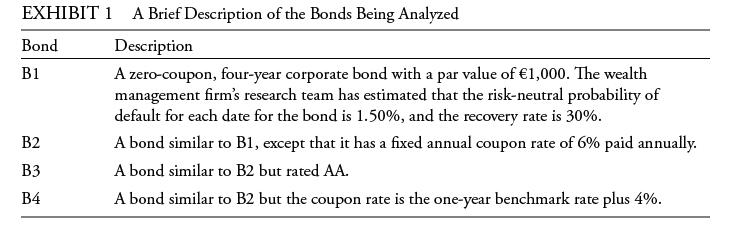

The firm invests in a variety of bonds. Ibarra is presently analyzing a set of bonds with some similar characteristics, such as four years until maturity and a par value of €1,000. Exhibit 1 includes details of these bonds.

Ibarra asks Koning to assist her with analyzing the bonds. She wants him to perform the analysis with the assumptions that there is no interest rate volatility and that the government bond yield curve is flat at 3%.

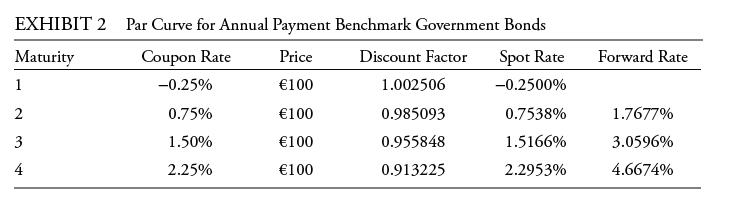

Ibarra performs the analysis assuming an upward-sloping yield curve and volatile interest rates. Exhibit 2 provides the data on annual payment benchmark government bonds.

She uses these data to construct a binomial interest rate tree based on an assumption of future interest rate volatility of 20%.

Answer the first five questions (1–5) based on the assumptions made by Marten Koning, the junior analyst. Answer Questions 8–12 based on the assumptions made by Daniela Ibarra, the senior analyst.

All calculations in this problem set are carried out on spreadsheets to preserve precision. The rounded results are reported in the solutions.

During the presentation about how the research team estimates the probability of default for a particular bond issuer, Lok is asked for his thoughts on the shape of the term structure of credit spreads. Which statement is he most likely to include in his response?

A. The term structure of credit spreads typically is flat or slightly upward sloping for high-quality investment-grade bonds. High-yield bonds are more sensitive to the credit cycle, however, and can have a more upwardly sloped term structure of credit spreads than investment-grade bonds or even an inverted curve.

B. The term structure of credit spreads for corporate bonds is always upward sloping— more so the weaker the credit quality because probabilities of default are positively correlated with the time to maturity.

C. There is no consistent pattern for the term structure of credit spreads. The shape of the credit term structure depends entirely on industry factors.

Step by Step Answer: