Question: Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants

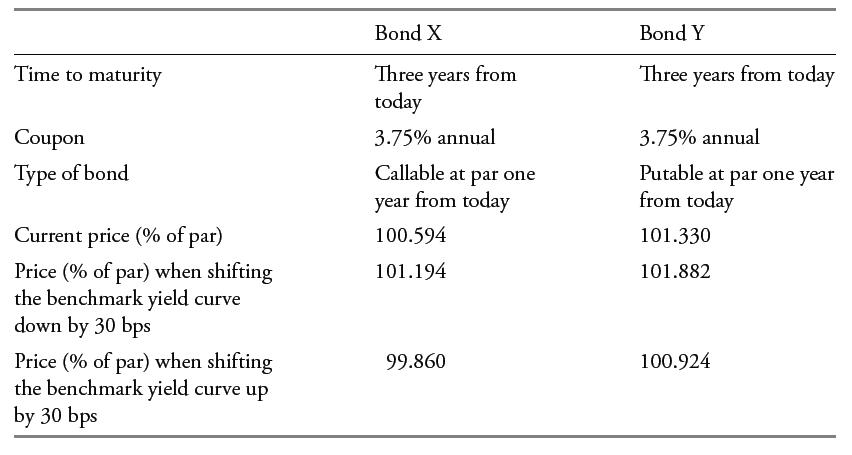

Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants to examine the interest rate sensitivity of these two bonds to a parallel shift in the benchmark yield curve. Assuming an interest rate volatility of 10%, her valuation software shows how the prices of these bonds change for 30 bps shifts up or down: Which of the following statements is most accurate?

Which of the following statements is most accurate?

A. Bond Y exhibits negative convexity.

B. For a given decline in interest rate, Bond X has less upside potential than Bond Y.

C. The underlying option-free (straight) bond corresponding to Bond Y exhibits negative convexity.

Time to maturity Coupon Type of bond Current price (% of par) Price (% of par) when shifting the benchmark yield curve down by 30 bps Price (% of par) when shifting the benchmark yield curve up by 30 bps Bond X Three years today 3.75% annual from Callable at par one year from today 100.594 101.194 99.860 Bond Y Three years from today 3.75% annual Putable at par one year from today 101.330 101.882 100.924

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

B is correct As interest rates decline the value of a call option increases whereas the val... View full answer

Get step-by-step solutions from verified subject matter experts