Returning to our earlier example of the investment-grade German media and telecommunications issuer, the investor decides instead

Question:

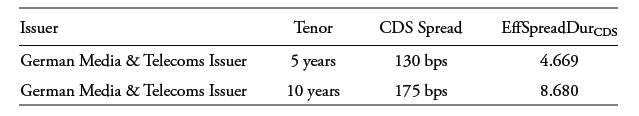

Returning to our earlier example of the investment-grade German media and telecommunications issuer, the investor decides instead to overweight exposure to this name by taking a long risk position in the single-name 10-year CDS market for one year. Details of today’s 5-year and 10-year CDS contracts are as follows.

Describe the roll-down strategy using CDS and calculate the one-year return in euros on a €10,000,000 position assuming an annual coupon payment and a 9 year EffSpreadDurCDS of 7.91.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: