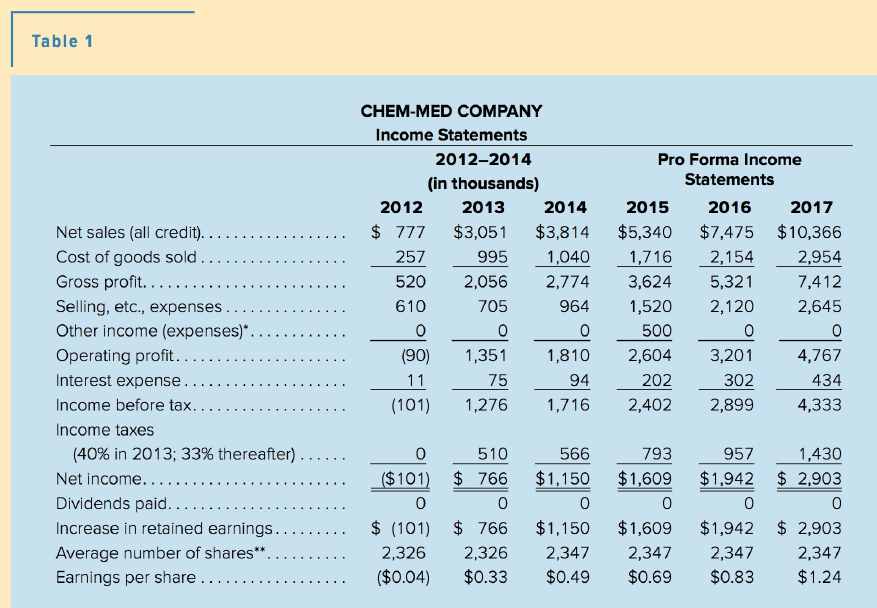

a. What was Chem-Med's rate of sales growth in 2014? What is it forecasted to be in

Question:

b. What is the company's rate of net income growth in 2015, 2016, and 2017? Is projected net income growing faster or slower than projected sales? After computing these values, take a hard look at the 2012 income statement data to see if you want to make any adjustments.

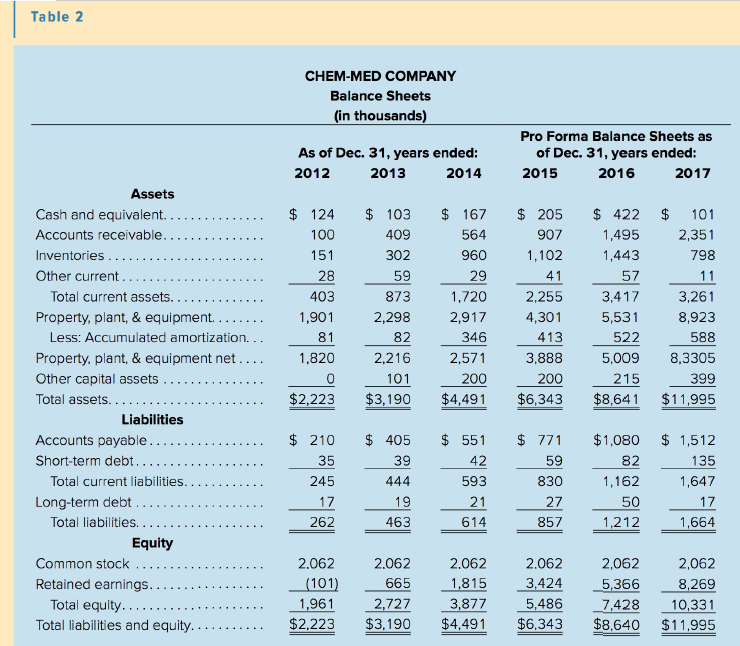

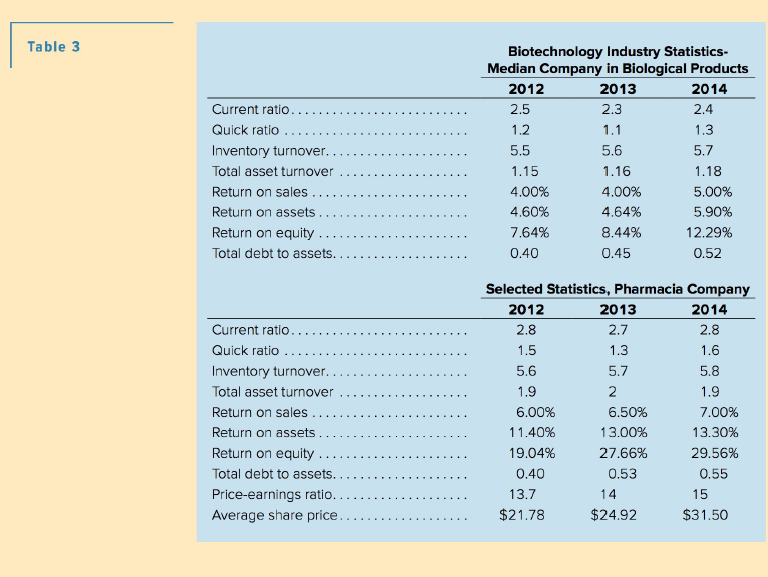

c. How does Chem-Med's current ratio for 2014 compare to Pharmacia's? How does it compare to the industry average? Compute Chem-Med's current ratio for 2017. Is there any problem with it?

d. What is Chem-Med's total debt-to-assets ratio in 2014, 2015,2016, and 2017? Is any trend evident in the four-year period? Does Chem-Med in 2014 have more or less debt than the average company in the industry?

e. What is Chem-Med's average accounts receivable collection period for 2014, 2015, 2016, and 2017? Is the period getting longer or shorter? What are the consequences?

f. How does Chem-Med's ROE compare to Pharmacia's and the industry for 2014?

Using the DuPont method, compare the positions of Chem-Med and Pharmacia by computing ROE from its components. Using the results compare the sources of ROE for each company.

g. For 2014, 2015, 2016, and 2017 calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the DOL, DFL, and the DCL. Discuss the risk of the company.

CHEM-MED COMPANY

April 1, 2016: Dr. Nathan Swan, age 40, chairman of the board of directors, chief executive officer, and founder of the Chem-Med Company was in his office staring at the ceiling, wondering if he would not have been better off still teaching biochemistry at the University of Toronto. This business was getting to be a headache. Only a short time ago he was able to spend most of his time in the company lab comfortably working with test tubes and formulas. Lately, though, it seemed that all his waking hours were spent with financial statements, spreadsheets, and in meetings. He wanted the firm to grow and make money, but he had no idea that the financial end of the business would be so demanding and complex.

Dr. Swan was a little mystified by financial matters. How could one describe a company in financial terms? How could financial statements indicate whether or not a firm was in good or bad shape? (The balance in the company chequing account didn't seem to be an indicator.) How could one convince a group of hard-nosed investors that the company was capable of making a lot of money in the next few years, if it just had more money now? (Dr. Swan was always puzzled by the fact that Chem-Med was growing and making money, but it never seemed to have enough cash.)

Chem-Med began operations in 1998 after Dr. Francois Swan completed the development of commercial-scale isolation of sodium hyaluronate (hereafter referred to as HA), a naturally occurring biological fluid that is useful in eye surgery and other medical and veterinary uses. The isolation process, complex and proprietary to the company, involves extracting and purifying HA from rooster combs. Initial seed money for the enterprise came from research grants from the University of Toronto and the federal government, plus contributions from Dr. Swan's colleagues and associates, who were now classified as the company's shareholders (254 as of April 2015, all closely held; not traded publicly).

In mid-2015 Chem-Med commenced the manufacture and distribution of its first product, VISCAM, which is used to hold tissues in place during and after surgery of the retina. In March 2015 Chem-Med received regulatory approval to market another HA product known as VISCHY, which is used for the treatment of degenerative joint....................

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta