Alpha Biogenetics was founded 13 years ago by Steve Menger, PhD, M.D. At the time, the company

Question:

Alpha Biogenetics was founded 13 years ago by Steve Menger, PhD, M.D. At the time, the company consisted of little more than a one-room laboratory, Dr. Menger, and a lab assistant. However, Dr. Menger's outstanding research attracted the attention of the Scientific Venture Capital Fund, and by 20XT the venture capital fund had contributed $4 million in so-called "risk capital" funding. The financial support of the fund along with the work of Dr. Menger and other scientists who joined the company allowed Alpha Biogenetics to develop potential leading?edge drugs in the areas of growth hormones, microgenes, and glycosylation inhibitors.

In the year 20XT, the company achieved its first profit of $1 ,600,000 and made a public offering of 2 million new shares at a price of $9.60 per share. At the same time, the Scientific Venture Capital Fund sold the 1.2 million shares it had received for its capital contributions, also at $9.60 per share. In the parlance of investment banking, the venture capitalist "cashed in its position."

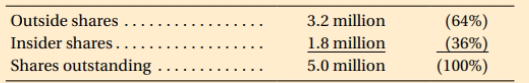

Between the 2 million new shares sold by the firm and the 1.2 million old shares sold by the venture capitalist, 3.2 million shares were put in the hands of the public. At the same time, Dr. Menger held one million shares, three other PhDs working for the company had 600,000 shares in total, and Ami Barnes, the chief financial officer, owned 200,000 shares. Altogether, the insiders owned 1.8 million shares, or 36 percent of the total of 5 million shares outstanding.

By 20XX, total earnings had increased to $4,800,000, and the stock price was $33.60. Also, many of the firm's products were well received in the biotech community. However, there was one problem that troubled Dr. Menger and the other inside investors. They had control of only a minority interest of 36 percent of the shares outstanding. If an unfriendly takeover offer were to be made, they could be voted out of control of the company. In the early stages of the company's development, this was an unlikely event, but such was no longer the case. The company now had products that others in the biotech industry, such as Biogen, Cygnus, and Genentech might 'Arish to acquire though a takeover. Most of these firms had their own high-quality scientists who could quickly relate to the products being developed by Dr. Menger and Alpha Biogenetics.

Dr. Menger was particularly concerned because the year 20XY was not likely to be as good as prior ones and could make the company's shareholders a little Jess happy 'Arith its performance. Management was about to settle a lawsuit against the firm, which could have adverse consequences in the year 20XY. Also, two of the firm's major clients were encountering severe financial difficulties and certain write-offs related to this were inevitable in the year 20XY.

Dr. Menger expressed his concern to Bill Larson, who was a partrler in the investment banking firm of Caruthers, Larson, and Rosen. Bill had been heavily involved in the initial public offering in 20XX-4 of Alpha Biogenetics, when his firm was the lead underwriter.

In response to Dr. Menger's concerns about an unfriendly takeover, Bill suggested the possibility of a poison pill. He said that poison pill provisions were used by many public corporations to thwart potentially unfriendly takeovers.

Poison pills could take many different forms, but Bill suggested that the controlling inside shareholders be allowed to purchase up to 1,500,000 new shares in the firm at 70 percent of current market value if an outside group acquired 25 percent or more of the current shares outstanding. This provision could discourage a potential takeover offer, as we shall see. Furthermore, Bill explained that poison pills do not require the approval of shareholders to implement as is true of other forms of anti takeover amendments.

At the firm's 20XX annual meeting held in the second week of March 20XY, Dr.

Menger discussed the firm's financial performance for 20XX as well as seven other items on the agenda, including the election of members of the board of directors, the approval of the firm's auditors from Deloitte & Touche, and the announcement of the poison pill provision that the firm planned to implement in the next two months.

Dr. Menger was somewhat surprised at the strong reaction that he got on the latter item. An institutional shareholder that represented the Ontario Public Employees Retirement System (OPERS) said her multi-billion-dollar pension fund was really turned off by poison pill provisions, and that other large institutional investors felt the same way.

She said that the role of corporate management was to maximize shareholder wealth and anti? takeover provisions, such as poison pills, tended to discourage tender offers to purchase firms at premiums over current market value.

She further stated that poison pills tended to protect current management against the threat of being displaced and, therefore, gave them a feeling of security that sometimes Jed to poor decisions, and encouraged unusually high compensation packages and even potential laziness.

There was a hush in the room after her remarks. Dr. Menger felt compelled to answer her charges and stated that the poison pill provision was not intended to protect poor performance, but was being put into place to provide a sense of permanency to the current management. He said that if management became overly concerned with job security and short-term quarter-to-quarter performance, they would not take a longterm perspective that was essential to building a company for the future. As an example, he suggested that R&D expenditures might be cut back to beef up a quarterly earnings report.

He also said that a sense of security and permanency allowed the company to compete for top-notch scientists and managers who otherwise would be hesitant to give up their current positions to go to a company that was a takeover target. Bill Larson, the firm's investment banker, also got into the discussion. He said that although in certain instances poison pills thwarted potential shareholder value maximizing offers, in other cases they had the opposite effect. Because the company was protected against capricious or minimal takeover offers, companies that wanted to acquire firms with poison pill provisions tended to offer a premium price well above the average offer. This was necessary because the firm could easily deflect a normal offer.

As Dr. Menger took all these comments in, he decided to have one last meeting with his executive committee on the topic of implementing a poison pill provision.

a. What were the EPS and P / E ratio in the year that the firm went public (20XT)?

b. Assuming a 5 percent underwriting spread, and $120,000 in out-of-pocket costs, what were the net proceeds to the corporation?

c. What rate of return did the Scientific Venture Capital Fund earn on its $4 million investment? Does this appear to be reasonable?

d. What were EPS in 20XX? Based on the share price of $33.60, what was the P / E ratio?

e. Under the poison pill provision, how much would it cost an unfriendly outside party to acquire 25 percent of the shares outstanding at the 20XX share price?

f. Now assume an unfriendly outside party acquired all the shares not ovmed by the inside control group. How many shares must the inside control group buy from the corporation to maintain its majority position? \IVhat would be the total dollar cost?

g. Based on the pro and con arguments made at the annual meeting, do you think that poison pills are in the best interests of shareholders?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9781259265921

11th Canadian Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta