Ashley Homebuilding is about to go public. The investment firm of Blake, Webber and Company is attempting

Question:

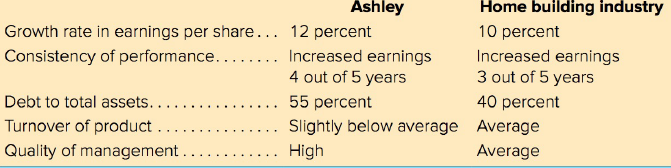

Assume, in assessing the initial P/E ratio, the investment dealer will first determine the appropriate industry P/E based on the S&P/TSX Composite Index. Then a half point will be added to the P/E ratio for each case in which Ashley Homebuilding is superior to the industry norm, and a half point will be deducted for an inferior comparison. On this basis, what should the initial P/E be for the firm?

DealerA dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: