Answer the following two independent questions. a. MM Corporation is considering several proposed investments for the...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

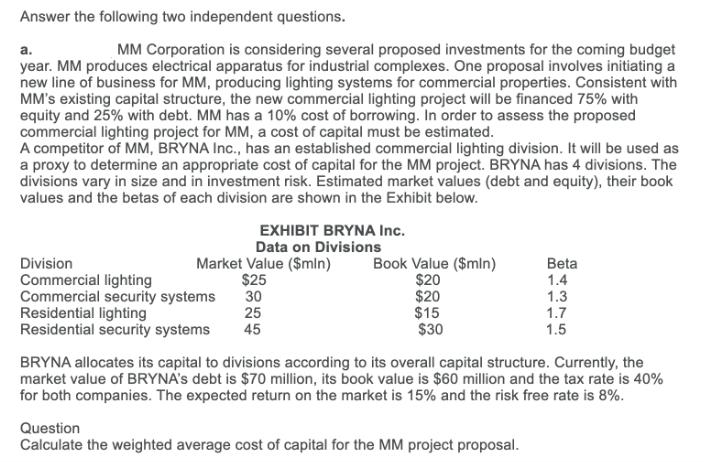

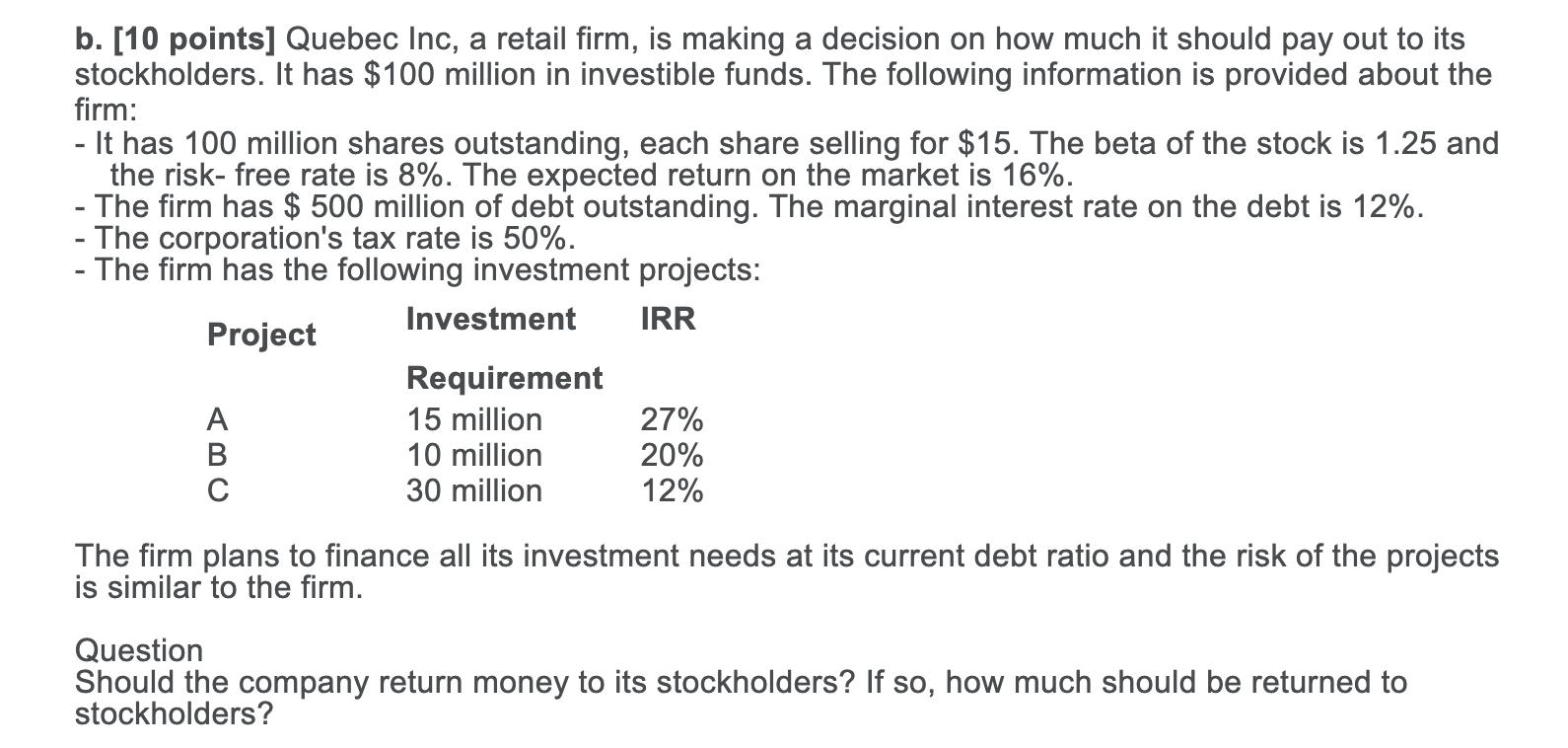

Answer the following two independent questions. a. MM Corporation is considering several proposed investments for the coming budget year. MM produces electrical apparatus for industrial complexes. One proposal involves initiating a new line of business for MM, producing lighting systems for commercial properties. Consistent with MM's existing capital structure, the new commercial lighting project will be financed 75% with equity and 25% with debt. MM has a 10% cost of borrowing. In order to assess the proposed commercial lighting project for MM, a cost of capital must be estimated. A competitor of MM, BRYNA Inc., has an established commercial lighting division. It will be used as a proxy to determine an appropriate cost of capital for the MM project. BRYNA has 4 divisions. The divisions vary in size and in investment risk. Estimated market values (debt and equity), their book values and the betas of each division are shown in the Exhibit below. EXHIBIT BRYNA Inc. Data on Divisions Market Value ($mln) Division Commercial lighting Commercial security systems Residential lighting Residential security systems $25 30 25 45 Book Value ($mln) $20 $20 $15 $30 Beta 1.4 1.3 Question Calculate the weighted average cost of capital for the MM project proposal. 1.7 1.5 BRYNA allocates its capital to divisions according to its overall capital structure. Currently, the market value of BRYNA's debt is $70 million, its book value is $60 million and the tax rate is 40% for both companies. The expected return on the market is 15% and the risk free rate is 8%. b. [10 points] Quebec Inc, a retail firm, is making a decision on how much it should pay out to its stockholders. It has $100 million in investible funds. The following information is provided about the firm: - It has 100 million shares outstanding, each share selling for $15. The beta of the stock is 1.25 and the risk-free rate is 8%. The expected return on the market is 16%. - The firm has $ 500 million of debt outstanding. The marginal interest rate on the debt is 12%. - The corporation's tax rate is 50%. - The firm has the following investment projects: IRR Project ABC Investment Requirement 15 million 10 million 30 million 27% 20% 12% The firm plans to finance all its investment needs at its current debt ratio and the risk of the projects is similar to the firm. Question Should the company return money to its stockholders? If so, how much should be returned to stockholders? Answer the following two independent questions. a. MM Corporation is considering several proposed investments for the coming budget year. MM produces electrical apparatus for industrial complexes. One proposal involves initiating a new line of business for MM, producing lighting systems for commercial properties. Consistent with MM's existing capital structure, the new commercial lighting project will be financed 75% with equity and 25% with debt. MM has a 10% cost of borrowing. In order to assess the proposed commercial lighting project for MM, a cost of capital must be estimated. A competitor of MM, BRYNA Inc., has an established commercial lighting division. It will be used as a proxy to determine an appropriate cost of capital for the MM project. BRYNA has 4 divisions. The divisions vary in size and in investment risk. Estimated market values (debt and equity), their book values and the betas of each division are shown in the Exhibit below. EXHIBIT BRYNA Inc. Data on Divisions Market Value ($mln) Division Commercial lighting Commercial security systems Residential lighting Residential security systems $25 30 25 45 Book Value ($mln) $20 $20 $15 $30 Beta 1.4 1.3 Question Calculate the weighted average cost of capital for the MM project proposal. 1.7 1.5 BRYNA allocates its capital to divisions according to its overall capital structure. Currently, the market value of BRYNA's debt is $70 million, its book value is $60 million and the tax rate is 40% for both companies. The expected return on the market is 15% and the risk free rate is 8%. b. [10 points] Quebec Inc, a retail firm, is making a decision on how much it should pay out to its stockholders. It has $100 million in investible funds. The following information is provided about the firm: - It has 100 million shares outstanding, each share selling for $15. The beta of the stock is 1.25 and the risk-free rate is 8%. The expected return on the market is 16%. - The firm has $ 500 million of debt outstanding. The marginal interest rate on the debt is 12%. - The corporation's tax rate is 50%. - The firm has the following investment projects: IRR Project ABC Investment Requirement 15 million 10 million 30 million 27% 20% 12% The firm plans to finance all its investment needs at its current debt ratio and the risk of the projects is similar to the firm. Question Should the company return money to its stockholders? If so, how much should be returned to stockholders?

Expert Answer:

Answer rating: 100% (QA)

SOLUTION a To calculate the weighted average cost of capital WACC for the MM project proposal we need to calculate the cost of equity and the cost of ... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The following letter was sent to the SEC and the FASB by leaders of the business community. Dear Sirs: The FASB has been struggling with accounting for derivatives and hedging for many years. The...

-

THE SHOPPES AT RIVERSIDE Fonda L. Carter, Columbus State University Kirk Heriot, Columbus State University CASE DESCRIPTION This case asks the students to recommend a decision to a group of...

-

Read the case study of Statistics regarding the Lawler Grocery Store chain. The use of the sign test is demonstrated in this case study. In your opinion, what is the biggest benefit of the sign test?...

-

$45 is 60% of what amount? 6.

-

Your answers may vary from the answers given in the back of the text, depending on how you round your answers. Estimate the answer. There is no one correct estimate. Your answer, however, should be...

-

20. Consider again the Netscape PEPS discussed in this chapter and assume the following: the price of Netscape is $39.25, Netscape is not expected to pay dividends, the interest rate is 7%, and the...

-

Colter Company accumulates the following data concerning a mixed cost, using units produced as the activity level. (a) Compute the variable and fixed cost elements using the high-low method. (b)...

-

A firm collects $20,000 cash on a sale that occurred 30 days ago. What is the effect of this transaction on the financial statements? None of these. There is no impact to the financial statements. o...

-

According to an extensive survey conducted for Business Marketing by Leo J. Shapiro & Associates, 66% of all computer companies are going to spend more on marketing this year than in previous years....

-

A pension plan is obligated to pay out $1 million at the end of year 2 and $3 million at the end of year 5. What is the duration if the interest rate is 10% annually?

-

9. [10] Suppose that B and W are BMs and that they are correlated with correlation coefficient P (-1, 1) in the sense that the correlation coefficient between Bt and Wt for all t>0. Then we can...

-

You have just incorporated and started your business. Your corporate pre-tax profit is $40,000. This is your only source of income. This income is eligible for the Small Business Deduction and is...

-

4. Provide the information requested in the statements below: a) Find and draw all C's that do not contain H's (if any). For this, redraw the structure where you show the d ('s). N b) Find and draw...

-

Suppose that f(x) = 8x + 5. (A) Find the slope of the line tangent to f(x) at x = 7. (B) Find the instantaneous rate of change of f(x) at x = -7. C) Find the equation of the line tangent to f(x) at x...

-

Whichof the following regarding the relationship between business risk and financial risk is least accurate based on our discussions in class? A. Business risk represents uncertainty caused by...

-

n response to intensive foreign competition, the management of Florex Company has attempted over the past year to improve the quality of its products. A statistical process control system has been...

-

In the circuit shown in Figure 4, a battery supplies a constant voltage of 40 V, the inductance is 2 H, the resistance is 10, and l(0) = 0. (a) Find l(t). (b) Find the current after 0.1s.

-

Distinguish between an integrated and interlocking accounting system.

-

Pharmaceutical Technologies Co. (PT) is a developer and manufacturer of medical drugs in Beeland, It is one of the 100 largest listed companies on the national stock exchange. The company focuses on...

-

Valet Co is a car valeting (cleaning) company. It operates in the country of Strappia, which has been badly affected by the global financial crisis. Petrol and food prices have increased...

-

15. A primary government can be either a general purpose government or a special purpose government. What is the difference in these two? How does an activity qualify as a special purpose government?

-

17. What is the difference between a blended component unit and a discretely presented component unit?

-

16. The Willingham Museum qualifies as a component unit of the City of Willingham. How does an activity or function qualify to be a component unit of a primary government?

Study smarter with the SolutionInn App