Question: Compute the book value per common share for 2014 and 2015 for the Maris Corporation. WINFIELD CORPORATION Income Statement Year Ended December 31 , 2015

Compute the book value per common share for 2014 and 2015 for the Maris Corporation.

WINFIELD CORPORATION

Income Statement

Year Ended December 31 , 2015

Sale..............................................................$210,000

Cost of Goods..................................................87,500

Gross profits .......... . . . ... . .......... . . ............122,500

Sell ing and administrative expense.................95,900

Amortization expense .. . ................ . ..............10,500

Operating income.............................................16,100

Interest expense ........ ... . . . . . .. .. . ... . ... ... . .3,500

Other income and losses:

Gain on sale of investment.................................5,250

Dividend income ..... . ....... ................................1,575

Loss on sale of equipment .................................1,050

Net other income and losses ... . ........ .. .. .. .. .. 5,775

Earn ings before taxes ......... . ........ .. .. .. .. . ...18,375

Income taxes .............. . . ....................................4,375

Net income ................ . ............ . ...................$ 14,000

During 2015, the following occurred:

a. From the long-term investments, a dividend of $1,575 was received. Shares originally costing $3,500 were sold for $8,750 from the investment account.

b. Land was purchased for $8,750. Purchase was completed with a note payable of $8,750, with interest and principal due in 12 months.

c. New equipment was purchased for $15,750 cash. Old equipment originally costing $7,000 with accumulated amortization of $3,500 was sold for $2,450.

d. Notes payable at $6,125 were paid.

e. Bonds were sold at par for $5,250.

f. A dividend of $6,650 was paid.

The 2015 amortization expense was $3,500 for buildings and $7,000 for equipment.

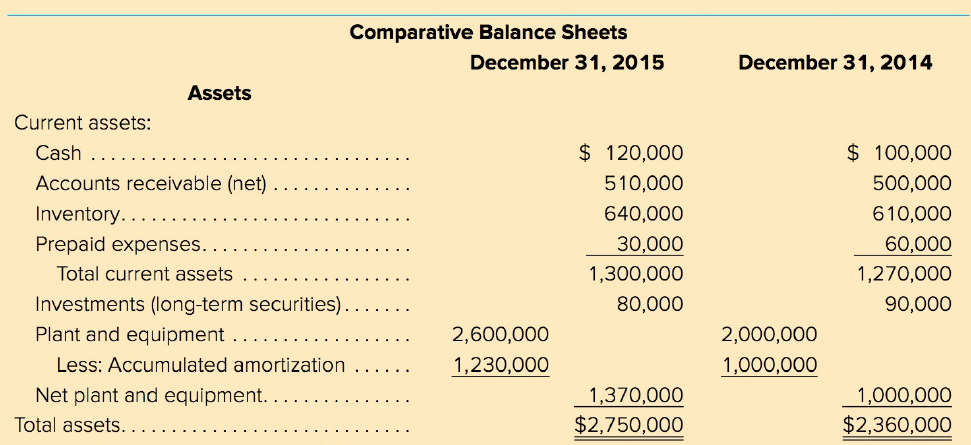

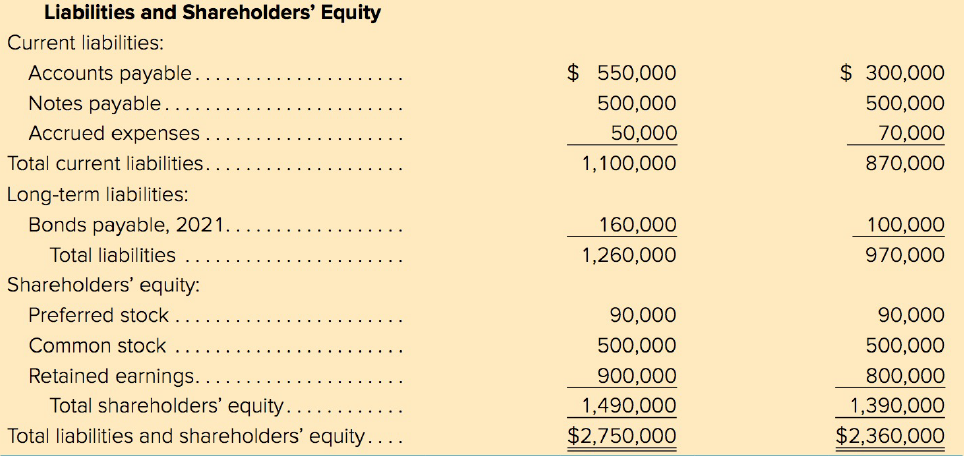

MARIS CORPORATION

Income Statement

Year ended December 31,2015

Sales................................................................................$3,300,000

Cost of goods sold .. ... . ..... . . . .. .. . ... . .... .. . . .... .. ... .1,950,000

Gross profits ...................... . . . . . .... .. .. .. .. .. . . ........... .1,350,000

Selling and administrative expense .... . . . . . .... .. .. ... . . . .650,000

Amortization expense ................... . .....................................230,000

Operating income..................................................................470,000

Interest expense......................................................................80,000

Earnings before taxes ...... . .. .. .. . . . . . .... .. .. .. .. .. . . .......390,000

Taxes ....................... . .. .. . . . . . . . .... .. .. .. . . . . . . .............140,000

Earnings after taxes .......... ....................................................250,000

Preferred stock dividends .................... ....................................10,000

Earnings available to common shareholders ..... .. . . .. .. . ..$ 240,000

Shares outstanding ...... ..... ............ ... ...................................150,000

Earnings per share.....................................................................$1.60

Statement of Retained Earnings

For the Year Ended December 31, 2015

Retained earnings, balance, January 1, 2015 ................. . .$800,000

Add: Earnings available to common shareholders, 201 5 .....240,000

Deduct: Cash dividends declared and paid in 2015...............140,000

Retained earnings, balance, December 3 1, 2015 ........ . ....$900,000

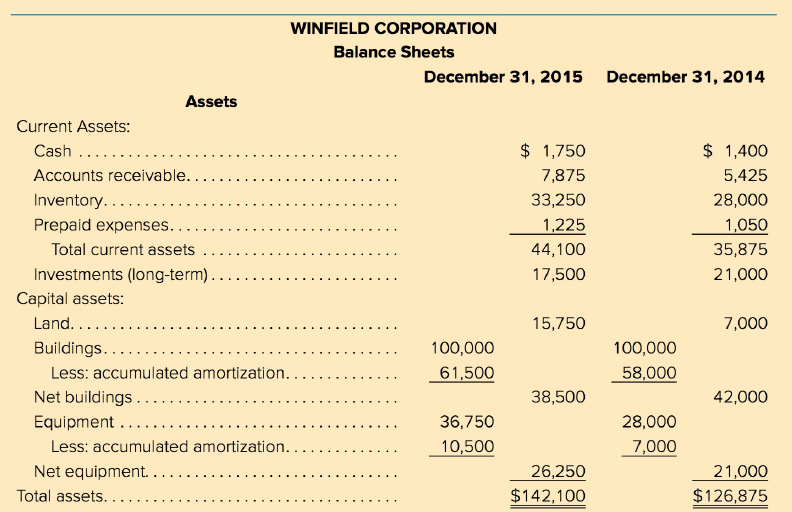

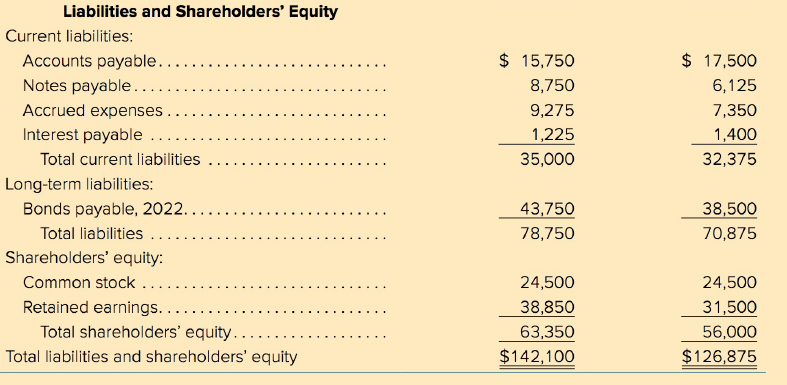

WINFIELD CORPORATION Balance Sheets December 31, 2015 December 31, 2014 Assets Current Assets: $ 1,750 $ 1,400 Cash .... Accounts receivable. 7,875 5,425 Inventory.... Prepaid expenses.... 33,250 28,000 1,225 1,050 Total current assets 44,100 35,875 Investments (long-term). 17,500 21,000 Capital assets: Land.... 15,750 7,000 Buildings. 100,000 100,000 61,500 Less: accumulated amortization. 58,000 Net buildings .. 38,500 42,000 Equipment ... 36,750 28,000 Less: accumulated amortization. 10,500 7,000 Net equipment... 26,250 $142,100 21,000 $126,875 Total assets. . Liabilities and Shareholders' Equity Current liabilities: Accounts payable.... $ 15,750 $ 17,500 Notes payable.... 8,750 6,125 Accrued expenses 9,275 7,350 Interest payable 1,225 35,000 1,400 Total current liabilities 32,375 Long-term liabilities: Bonds payable, 2022.. 43,750 38,500 Total liabilities 78,750 70,875 Shareholders' equity: Common stock ... Retained earnings... 24,500 24,500 38,850 31,500 Total shareholders' equity. 63,350 56,000 $126,875 Total liabilities and shareholders' equity $142,100

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Maris Corporation Book value per share Shareholders equity Preferred ... View full answer

Get step-by-step solutions from verified subject matter experts