Prepare a statement of cash flows for the Maris Corporation. MARIS CORPORATION Income Statement Year ended December

Question:

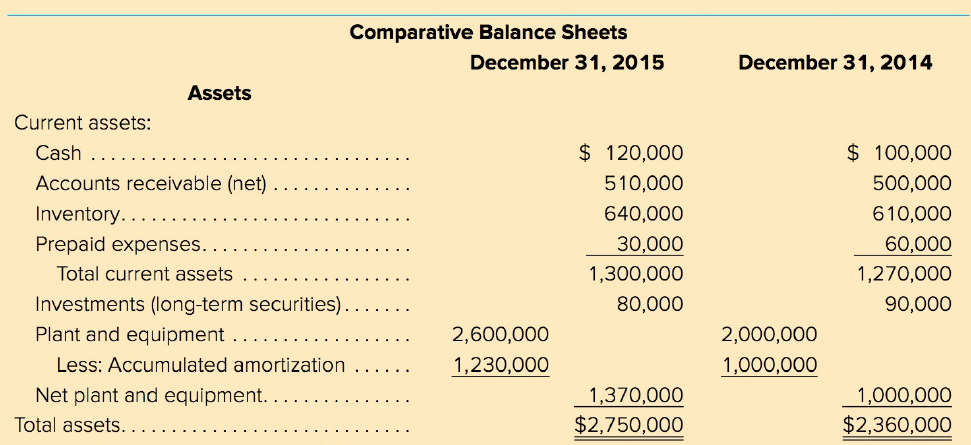

MARIS CORPORATION

Income Statement

Year ended December 31,2015

Sales................................................................................$3,300,000

Cost of goods sold .. ... . ..... . . . .. .. . ... . .... .. . . .... .. ... .1,950,000

Gross profits ...................... . . . . . .... .. .. .. .. .. . . ........... .1,350,000

Selling and administrative expense .... . . . . . .... .. .. ... . . . .650,000

Amortization expense ................... . .....................................230,000

Operating income..................................................................470,000

Interest expense......................................................................80,000

Earnings before taxes ...... . .. .. .. . . . . . .... .. .. .. .. .. . . .......390,000

Taxes ....................... . .. .. . . . . . . . .... .. .. .. . . . . . . .............140,000

Earnings after taxes .......... ....................................................250,000

Preferred stock dividends .................... ....................................10,000

Earnings available to common shareholders ..... .. . . .. .. . ..$ 240,000

Shares outstanding ...... ..... ............ ... ...................................150,000

Earnings per share.....................................................................$1.60

Statement of Retained Earnings

For the Year Ended December 31, 2015

Retained earnings, balance, January 1, 2015 ................. . .$800,000

Add: Earnings available to common shareholders, 201 5 .....240,000

Deduct: Cash dividends declared and paid in 2015...............140,000

Retained earnings, balance, December 3 1, 2015 ........ . ....$900,000

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta