For December 31 , 2014, the balance sheet of the Gardner Corporation is as follows: Sales for

Question:

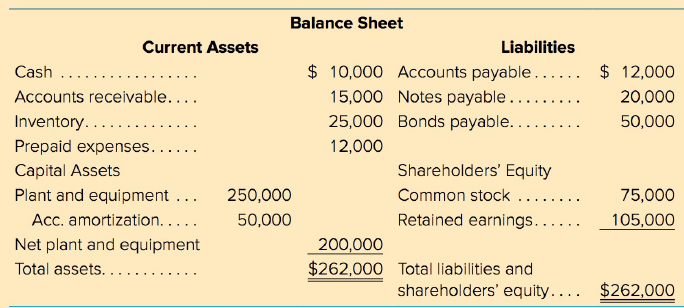

For December 31 , 2014, the balance sheet of the Gardner Corporation is as follows:

Sales for 2015 were $220,000, with cost of goods sold being 60 percent of sales. Amortization expense was 10 percent of plant and equipment (net) at the beginning of the year. Interest expense for the bonds payable was 8 percent, while interest on the notes payable was 10 percent. These are based on December 31,2014, balances. Selling and administrative expenses were $22,000, and the tax rate averaged 18 percent.

During 2015, the cash balance and prepaid expense balance were unchanged. Accounts receivable and inventory each increased by 10 percent, and accounts payable increased by 25 percent. A new machine was purchased on December 31, 2015, at a cost of $35,000. A cash dividend of $12,800 was paid to common shareholders at the end of 2015. Also, notes payable increased by $6,000 and bonds payable decreased by $10,000. The common stock account did not change.

a. Prepare an income statement for 2015.

b. Prepare a balance sheet as of December 31, 2015.

c. Prepare a statement of cash flows for the year ending December 31,2015.

Identify the major accounts contributing to the change in cash position, from the three different components of the cash flow statement.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta