Question: In the previous problem, what long-term interest rate would represent a break-even point between using short term financing as described in part a and long-term

In the previous problem, what long-term interest rate would represent a break-even point between using short term financing as described in part a and long-term financing? Divide the interest payments in Problem 8. a by the amount of total funds provided for the six months and multiply by 12.

Previous problem

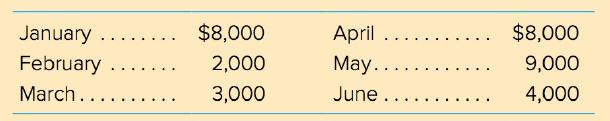

Liz's Health Food Store has estimated monthly financing requirements for the next six months as follows:

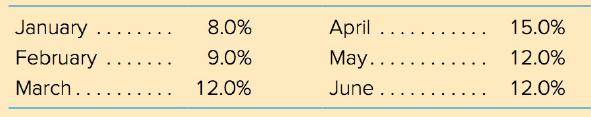

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

January $8,000 April $8,000 ... February 2,000 May... 9,000 ... March.... 3,000 June .... 4,000

Step by Step Solution

3.56 Rating (174 Votes )

There are 3 Steps involved in it

The breakeven point between using shortterm financi... View full answer

Get step-by-step solutions from verified subject matter experts