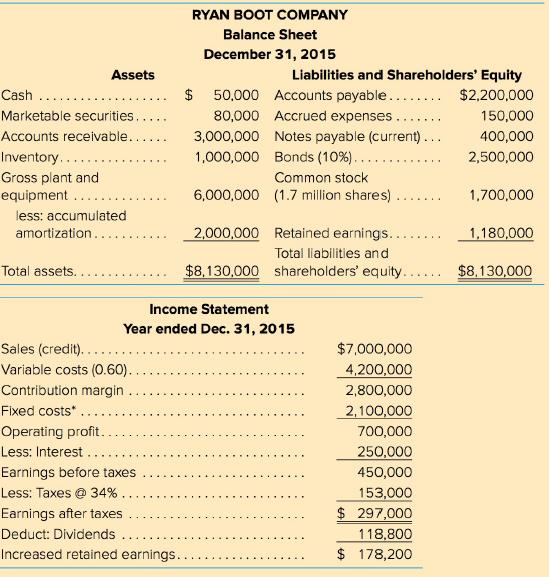

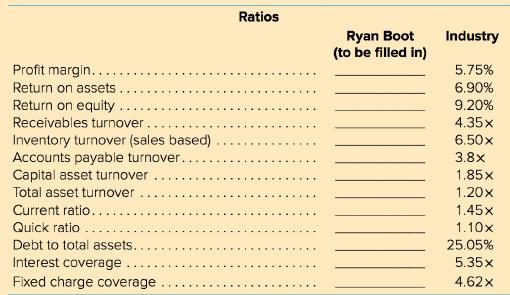

Question: a. Analyze Ryan Boot Company using ratio analysis. Compute the ratios above for Ryan Boot and compare them to the industry data that is given.

a. Analyze Ryan Boot Company using ratio analysis. Compute the ratios above for Ryan Boot and compare them to the industry data that is given. Discuss the weak points, strong points, and what you think should be done to improve the company's performance.

b. In your analysis, calculate the overall break-even point in sales dollars and the cash break-even point. Also compute the DOL, DFL, and DCL.

c. Use the information in parts a and b to discuss the risk associated with this company. Given the risk, decide whether a bank should loan funds to Ryan Boot. Ryan Boot Company is trying to plan the funds needed for 2017. The management anticipates an increase in sales of 20 percent, which can be absorbed without increasing capital assets.

d. What would be Ryan Boot's need for external funds based on the current balance sheet? Compute RNF (required new funds). Notes payable (current) and bonds are not part of the liability calculation.

e. What would be the RNF if the company brings its ratios into line with the industry average during 2016? Specifically examine receivables turnover, inventory turnover, and the profit margin. Use the new values to recompute the factors in RNF (assume liabilities stay the same).

f. Do not calculate, only comment on the following questions. How would RNF change if the company:

1. Were at full capacity?

2. Raised the dividend payout ratio?

3. Suffered a decreased growth in sales?

4. Faced an accelerated inflation rate?

*Fixed costs include (a) lease expense of $200,000 and (b) amortization of $500,000. Note: Ryan Boot also has $66,000 per year in sinking fund obligations associated with its bond issue . The sinking fund represents an annual repayment of the principal amount of the bond. It is not tax deductible.

RYAN BOOT COMPANY Balance Sheet December 31, 2015 Assets Liabilities and Shareholders' Equity $ 50,000 Accounts payable...... $2,200,000 Cash Marketable securities.. Accounts receivable.. 80,000 Accrued expenses 150,000 3,000,000 Notes payable (current)... 1,000,000 Bonds (10%).... 400,000 Inventory...... 2,500,000 Common stock Gross plant and equipment 6,000,000 (1.7 million shares) 1,700,000 ..... less: accumulated amortization.. 2,000,000 Retained earnings.... 1,180,000 Total liabilities an d Total assets. $8,130,000 shareholders' equity..... $8,130,000 Income Statement Year ended Dec. 31, 2015 Sales (credit). $7,000,000 ...... Variable costs (0.60). 4,200,000 Contribution margin 2,800,000 Fixed costs*.. 2,100,000 Operating profit. 700,000 Less: Interest 250,000 450,000 153,000 $297,000 Earnings before taxes Less: Taxes @ 34% . Earnings after taxes Deduct: Dividends 118,800 Increased retained earnings. $ 178,200

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

a Ryan Boot Company s profit margin of 6 90 is slightly higher than the industry average of 5 75 indicating that the company is managing its costs well and is able to earn higher profits The return on ... View full answer

Get step-by-step solutions from verified subject matter experts