Karamos Shoe Stores Inc. is considering opening an additional suburban outlet. An aftertax expected cash flow of

Question:

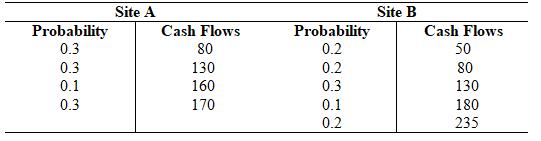

Karamo’s Shoe Stores Inc. is considering opening an additional suburban outlet. An aftertax expected cash flow of $130 per week is anticipated from two stores that are being evaluated. Both stores have positive net present values.

Which store site would you select based on the distribution of these cash flows? Use the coefficient of variation as your measure of risk.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Financial Management

ISBN: 9781264097623

18th Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

Question Posted: