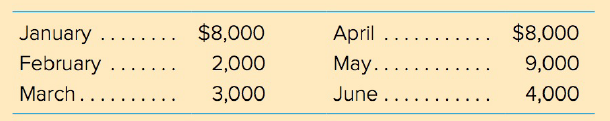

Liz's Health Food Store has estimated monthly financing requirements for the next six months as follows: Short-term

Question:

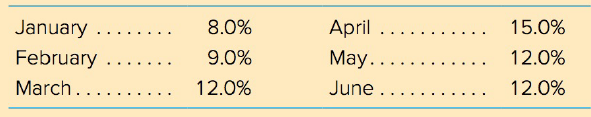

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

a. Compute total dollar interest payments for the six months. To convert an annual rate to a monthly rate, divide by 12.

b. If long-term financing at 12 percent had been utilized throughout the six months, would the total dollar interest payments be larger or smaller?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: