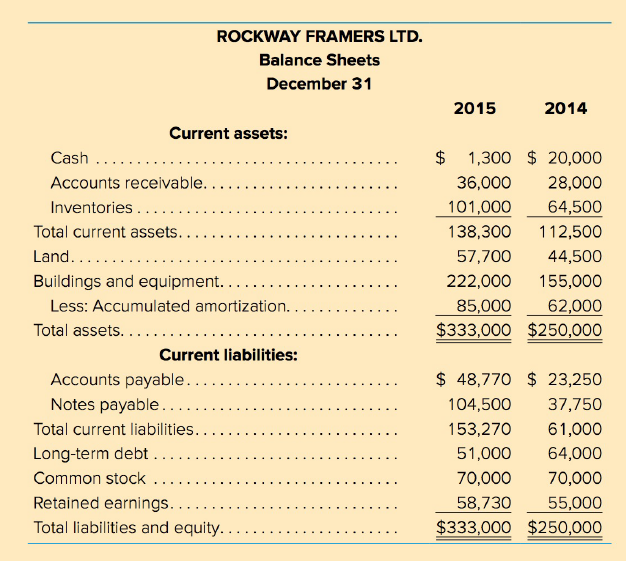

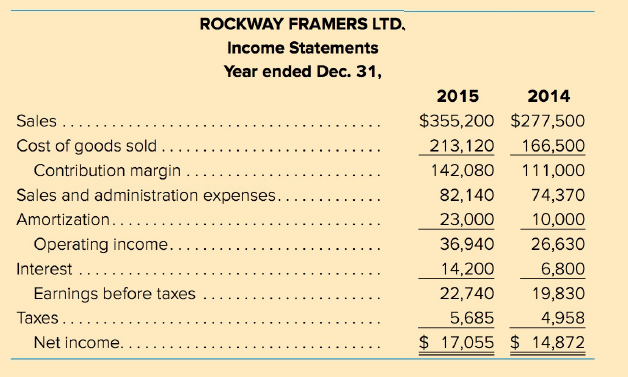

Rockway Framers Ltd. has requested a bank loan for a one-year period to refinance most of its

Question:

Industry Averages

Profit margin ............ . . . .............. .............. . . .3.50%

Return on assets................................................4.00%

Return on equity ........ .... .. .. .. . . . . . . . ... .......8.20%

Gross margin ........... . .. ..................................38.00%

Receivables turnover ....... . .. .. .. .. .... . ... ........9.73 times

Average coll ection period.................................37.51 days

Inventory turnover ....... ... . .. . . .. . . . ... . .. . ......2.50 times

Capital asset turnover..........................................2.08 times

Total asset turnover ...... . .. .. .. .. . ... . . . .. . ......1.14 times

Current ratio ...... . .. ..... .. .. .. .. . ........ . .............1.80

Quick ratio .......... . ..... ........................................0.70

Debt to total assets. . ... . .. ... . .. ...... . . . . ........58.00%

Times interest earned ..... .. .. .. .. .. . . . . . . . . .....3.80 times

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta