ABBC, Inc. operates a very successful chain of yogurt and coffee shops spread across the southwestern part

Question:

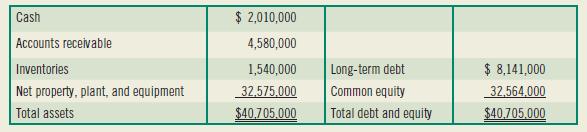

ABBC, Inc. operates a very successful chain of yogurt and coffee shops spread across the southwestern part of the United States and needs to raise funds for its planned expansion into the Northwest. The firm’s balance sheet at the close of 2015 appeared as follows:

At present, the firm’s common stock is selling for a price equal to 3 times its book value, and the firm’s investors require a 15 percent return. The firm’s bonds command a yield to maturity of 8 percent, and the firm faces a marginal tax rate of 21 percent. At the end of the previous year, ABBC’s bonds were trading their par value.

a. Describe ABBC’s capital structure?

b. What is ABBC’s weighted average cost of capital?

c. If ABBC’s stock price were to rise such that it sold at 3.5 times its book value and the cost of equity fell to 13 percent, what would the firm’s weighted average cost of capital be (assuming the cost of debt and tax rate do not change)?

d. Thought exercise. Historically ABBC has owned each of its yogurt shop stores. The firm’s new CFO has asked you to consider the potential effect on the firm’s cost of capital if it were to sell the stores to a real estate investor with an agreement to lease them back (i.e., rent them). No computations required.

Step by Step Answer:

Foundations Of Finance

ISBN: 9780135160619

10th Edition

Authors: Arthur J. Keown, John H. Martin, J. William Petty