It was another disappointing year for Bruce Honiball, the manager of retail services at the Gibb River

Question:

It was another disappointing year for Bruce Honiball, the manager of retail services at the Gibb River Bank. Sure, the retail side of Gibb River was making money, but it didn't grow at all in 2019. Gibb River had plenty of loyal depositors but few new ones. Bruce had to figure out some new product or financial service-something that would generate some excitement and attention.

Bruce had been musing on one idea for some time. How about making it easy and safe for Gibb River's customers to put money in the stock market? How about giving them the upside of investing in equities-at least some of the upside-but none of the downside? Bruce could see the advertisements now:

How would you like to invest in Australian stocks completely risk-free? You can with the new Gibb River Bank Equity-Linked Deposit. You share in the good years; we take care of the bad ones.

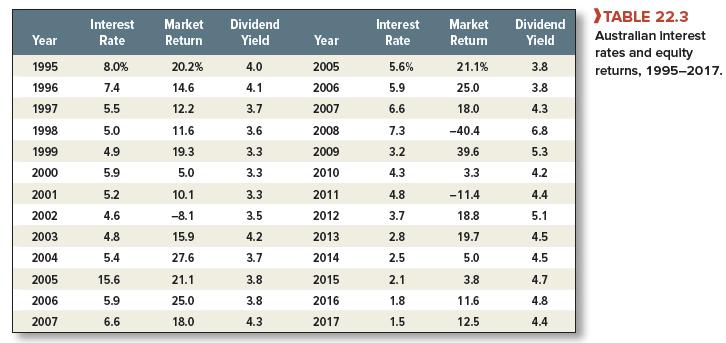

Here's how it works. Deposit A$100 with us for one year. At the end of that period, you get back your A$100 plus A$5 for every 10% rise in the value of the Australian All Ordinaries stock index. But, if the market index falls during this period, the Bank will still refund your A$100 deposit in full. There's no risk of loss. Gibb River Bank is your safety net.

Bruce had floated the idea before and encountered immediate skepticism, even derision: "Heads they win, tails we lose-is that what you're proposing, Mr. Honiball?" Bruce had no ready answer.

QUESTION

What kinds of options is Bruce proposing? How much would the options be worth? Would the equity-linked and bear-market deposits generate positive NPV for Gibb River Bank?

Step by Step Answer: