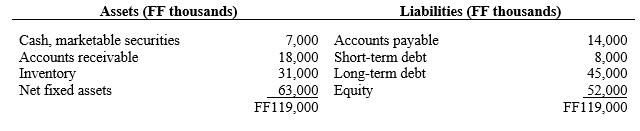

Halon France, the French subsidiary of a U.S. company, Halon, Inc., has the following balance sheet: a.

Question:

Halon France, the French subsidiary of a U.S. company, Halon, Inc., has the following balance sheet:

a. At the current spot rate of $0.21/FF, calculate Halon France’s accounting exposure under the currentoncurrent, monetaryonmonetary, temporal, and current rate methods.

b. Suppose the French franc depreciates to $0.17. Produce balance sheets for Halon France at the new exchange rate under each of the four alternative translation methods.

c. Calculate the translation gains or losses associated with the FF depreciation for each of the four methods. Relate these gains and losses to the exposure calculations performed in part a combined with the exchange rate change. Where would these translation gains or losses show up in the balance sheets prepared for part b?

Step by Step Answer:

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin