Although Janet Lambert has run a small business for many years, she has never kept adequate accounting

Question:

Although Janet Lambert has run a small business for many years, she has never kept adequate accounting records. However, a need to obtain a bank loan for the expansion of the business has necessitated the preparation of 'final' accounts for the year ended 31 August 2019. As a result, the following information has been obtained after much careful research:

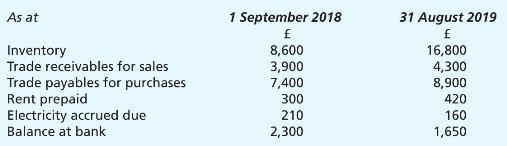

1 Janet Lambert's business assets and liabilities are as follows:

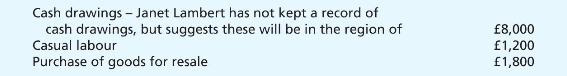

2 All takings have been banked after deducting the following payments:

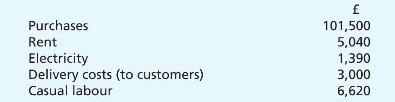

3 Bank payments during the year ended 31 August 2019 have been summarised as follows:

4 It has been established that a gross profit of \(33 \frac{1}{3} \%\) on cost has been obtained on all goods sold.

5 Despite her apparent lack of precise accounting records, Janet Lambert is able to confirm that she has taken out of the business during the year under review goods for her own use costing \(£ 600\).

\section*{Required:}

(a) Prepare a computation of total purchases for the year ending 31 August 2019.

(b) Prepare an income statement for the year ending 31 August 2019 and a balance sheet as at that date, both in as much detail as possible.

(c) Explain why it is necessary to introduce accruals and prepayments into accounting.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood