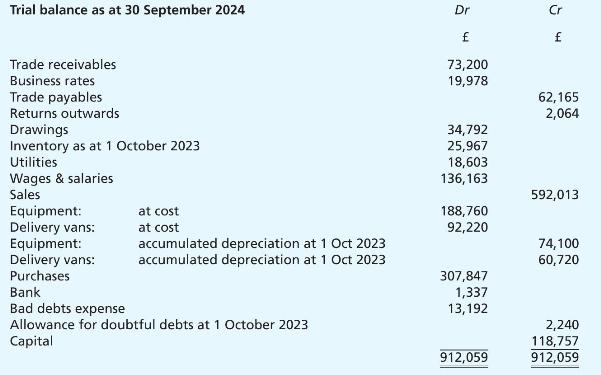

D. Staunton is a sole proprietor and you are given the following information relating to her business:

Question:

D. Staunton is a sole proprietor and you are given the following information relating to her business:

\section*{Additional information:}

1 The inventory was counted at 30 September 2024 and was valued at \(£ 26,424\).

2 Depreciation is to be applied at the following rates:

![]()

3 The amount shown for business rates on the trial balance includes a payment of \(£ 11,760\), which represents twelve months' business rates to 31 January 2025.

4 Utilities charges incurred for which no invoices have yet been received amount to a total of \(£ 4,167\).

5 Based on a careful analysis of the business's debt collection experience, the allowance for doubtful debts is to be set at \(4 \%\) of trade receivables.

\section*{Required:}

Prepare the following financial statements for D. Staunton's business:

(a) An income statement for the year ended 30 September 2024.

(b) A balance sheet as at 30 September 2024.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood