Mears, Pugh and Stafford were in partnership sharing profits and losses in the ratio 5:3:2 respectively. The

Question:

Mears, Pugh and Stafford were in partnership sharing profits and losses in the ratio 5:3:2 respectively.

The partners had agreed that the partnership would be dissolved on 1 April 2023.

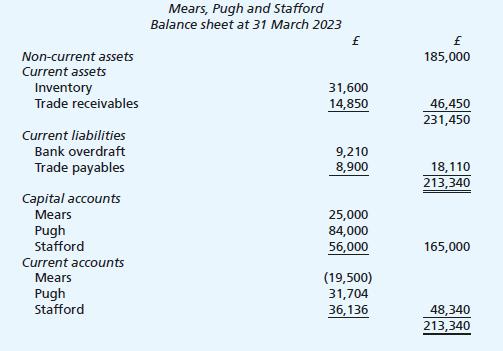

The partnership balance sheet at 31 March 2023 was as follows:

Additional information 1 A vehicle could have been sold for £18,800. However, because this would have generated a loss of £3,200, it was decided instead that Pugh would take the vehicle at its carrying amount as part of his settlement.

2 All other non-current assets were found to be impaired. They could only be disposed of for the recoverable amount. The fair value of these assets was £150,000 and the value in use was £125,000.

3 Inventory would usually be sold at a mark-up of 25% on cost price. However, because the inventory was damaged, it was actually sold for £14,220 less than this amount.

4 A bankrupt customer owed £2,350. All other trade receivables paid in full after being given a 5%

settlement discount.

5 The partnership is owed a refund of £100 from a supplier and this has not been accounted for. All other trade payables were settled in full after receiving a 2% discount.

6 The costs of dissolving the partnership of £1,951 were paid by cheque.

Mears was bankrupt and so was unable to repay any amounts owing to the partnership from her own personal finance.

Required:

(a) Prepare the realisation account for the partnership at 1 April 2023.

(b) Prepare the partnership capital accounts for Mears, Pugh and Stafford at 1 April 2023.

(c) Prepare the partnership bank account at 1 April 2023 to show all transactions relating to the dissolution of the partnership.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood