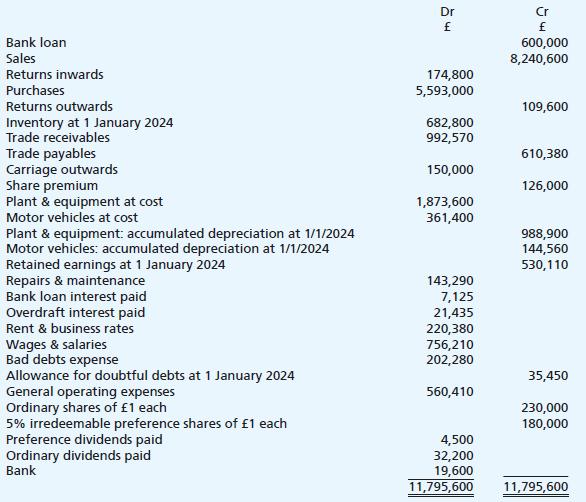

The following balances have been taken from the nominal ledger of Pandar plc as at 31 December

Question:

The following balances have been taken from the nominal ledger of Pandar plc as at 31 December 2024:

The following points also need to be considered before preparation of the financial statements:

(i) After producing the above trial balance, the following two mistakes have been detected in the accounting records:

• A repair bill totalling £15,600 (dated 12 August 2024) for the Chairman’s company car has been posted to the motor vehicles account; and • A credit note correctly given to a customer for £12,560 in November 2024 has been posted twice in the books.

(ii) Inventory as at 31 December 2024 was counted and valued at a cost of £703,820.

(iii) During the year, Pandar plc renewed its annual contract with Freightmax Ltd, the company that delivers the goods to Pandar plc’s customers. The renewal date of the contract was 1 November 2024 and the agreed renewal fee totalled £192,000. This amount will be paid in four quarterly instalments beginning on 1 February 2025. No entries have yet been made in the books in relation to this renewal.

(iv) The company’s depreciation policy is as follows:

• plant & equipment - 331/3% reducing balance • motor vehicles - 25% straight line.

(v) On 12 January 2025, Pickram Ltd (one of the company’s customers) went into liquidation. Trade receivables at 31 December 2024 include a total of £45,130 due from Pickram Ltd. The directors of Pandar plc have been advised that they are extremely unlikely to receive any of this amount.

Additionally, the directors believe that an allowance for doubtful debts of 3% of remaining trade receivables is required, based on a detailed review of the company’s experience with debt collection.

(vi) The bank loan was received on 1 August 2024. The loan is repayable in five equal annual instalments commencing on 31 July 2025. Interest is charged at a fixed rate of 4.75% per annum, and the interest is payable in quarterly instalments beginning on 31 October 2024.

(vii) The preference dividend is payable in two annual instalments. The second instalment has not been paid as at the year end and (under the specific terms of the company’s preference shares)

must be provided for.

(viii) In February 2025, the directors decided to propose a final ordinary dividend for 2024 of 18 pence per share.

(ix) The corporation tax charge on the profit for the year is estimated to be £16,670 (you should assume that this estimate is unaffected by the eight points above).

Required:

Prepare, in a publishable format, the income statement for the year ended 31 December 2024 for Pandar plc, followed by its balance sheet as at the same date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood