A, B and C are in partnership and share profits and losses in the ratio 2 :

Question:

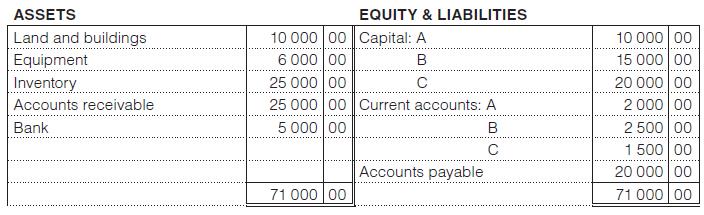

A, B and C are in partnership and share profits and losses in the ratio 2 : 2 : 1. The abridged statement of financial position of the partners on 30 June 20x1 was: (Ignore VAT.)

Interest is allowed at 5% per annum on capital, but no interest is charged on drawings. B and C receive salaries of R10 000 each per year, which they withdraw as required.

No proper records were kept by the partnership for the year ended 30 June 20x2. This information was, however, made available to you:

1. During the year R10 000 was spent on the property, which is regarded as capital expenditure.

2. A increased his capital by R10 000 on 1 January 20x2.

3. Accounts payable amounted to R30 000 on 30 June 20x2.

4. Accounts receivable amounted to R32 500 on 30 June 20x2 of which R2 500 should be written off as irrecoverable.

5. The value of inventory on 30 June 20x2 was R40 000.

6. On 30 June 20x2 the bank statement showed a favourable balance of R12 000, but a deposit of R1 000 was only credited in July and outstanding cheques amounted to R3 000.

7. Drawings for the year were:

You are required to:

1. Complete the current accounts (in full detail, in columnar form) in the general ledger of the partnership. Clearly show each partner’s share of profit.

2. Prepare the statement of financial position of the partnership as at 30 June 20x2.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit